Fuente: Harvard Law School Forum on Corporate Governance and Financial Regulation

Autor: Steve Klemash and Jennifer Lee, EY Center for Board Matters, and Kris Pederson, EY

Technology can enable innovation and disrupt existing business models. Many corporate leaders are increasingly considering how technology can improve operational efficiencies, create new products and services, and help their organizations enter untapped markets. They are also surveying the landscape for competitive entrants seeking to disrupt their industry.

Of course, adopting new technology can be challenging and have far-reaching effects both inside and outside of an organization. While many of these can be positive, others can lead to unforeseen risks and unintended consequences. For instance, implementation can bring about risks related to alignment with new or existing business models, resources and training, security and data management, and overall project management, to name just a few.

Overlooking the opportunities and risks related to disruptive technology can be costly, but so too can a rush to implement it. In this report, Corporate Board Member and EY present the key findings of a survey of 365 corporate directors on the topic of disruptive technology. Here’s what we found:

Key Findings

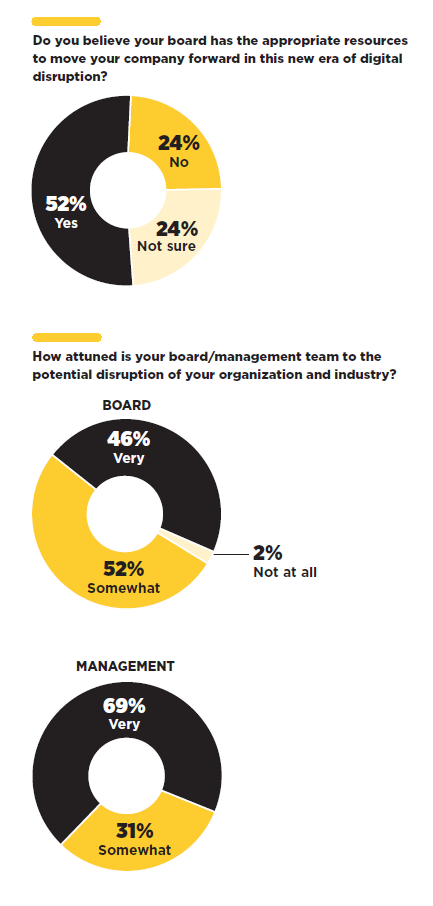

- Directors are divided as to whether their boards have the appropriate resources to move their companies forward in this era of digital disruption.

- Most boards rely on management as their primary source for staying current on industry trends, emerging technologies and innovation.

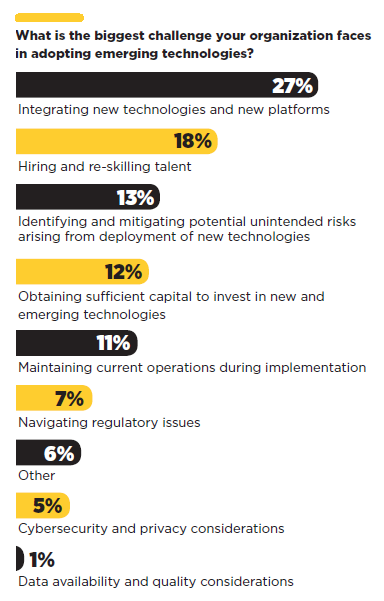

- Directors say the biggest challenges to adopting emerging technology are those related to integration and talent.

- Boards can help their organizations mitigate risks brought on by disruptive technology by including the topic on the full board agenda and reviewing the organization’s enterprise risk management framework

- A majority of directors agree that boards can enhance their oversight of disruptive technology through tailored board training and education.

Nearly half of the directors in our survey indicated being unconvinced that their boards have the appropriate resources to navigate the disruption caused by emerging technology.

Our data shows that boards are more confident in their management team’s acumen in these matters, with fewer than half (46 percent) of directors saying they feel “very attuned” to the potential disruption of their organization and industry, compared to 69 percent who responded the same about management.

This data underscores the need for today’s boards to take a step back and verify they have the portfolio of skills and competencies necessary to serve as a strategic resource and guide for management. The purview of directors is rapidly expanding as technological innovation drives new opportunities and risks, and boards should regularly challenge their composition to confirm that director qualifications align with the company’s evolving strategy and risk profile. Boards should also seek to ensure ongoing refreshment as a way to bring new, diverse and relevant perspectives into the boardroom. This could involve ongoing board training and education, challenging the quality of board materials, engaging outside experts, and verifying that the board’s agenda and committee structure provide sufficient focus on emerging strategic issues and critical risks.

Fifty-seven percent of directors say they primarily rely on briefings from management to stay current on business trends, emerging technologies and innovation. Approximately one quarter of respondents (27 percent) chose subject matter experts and other external sources, such as industry analysts, conferences, trade publications or publicly available data on peers and competitors, as a top source of information over their management team.

An overreliance on management briefings may not be the most effective way for boards to understand how emerging technologies can help drive new opportunities through innovation for their organizations. In fact, such an insular approach could limit the board’s awareness of opportunities and risks brought on by these technologies.

Instead, directors should look outside of their company to stay up to date on the latest developments related to emerging technologies and overall innovation. Independent external data can help them gain valuable insight into potential strategic pivots occurring within their company’s industry and adjacent sectors. For instance, it’s critical that boards receive timely information related to new business formation by venture and private capital, including rounds of financing along with overall joint venture, merger and acquisition activity. These new entrants are often leveraging emerging technologies to drive innovation and create disruptive business models challenging the status quo. This and similar external data will help the board constructively challenge internal biases, identify blind spots and bring an objective perspective.

Boards have a responsibility to support management undertaking innovative projects that offer long-term value—a principle with which 83 percent of directors agree. However, the inherent risks involved with pursuing disruptive technology, combined with external pressures for short-term profitability, may push management to overlook opportunities to create long-term value.

Despite directors’ acknowledgment of the importance of a long-term focus, many companies continue to grapple with balancing short- and long-term strategic objectives. But as highlighted in the survey responses, it is critical that boards sustain their vigilance with long-term value creation and support management’s long-term initiatives, even if such initiatives negatively impact short-term results.

Integrating new technologies and platforms is considered the greatest challenge when adopting emerging technologies, followed by hiring and re-skilling talent.

To address these concerns, boards should verify that any implementation of new technology involves an appropriate project and risk management process that aligns to the organization’s enterprise risk management (ERM) framework. Leveraging external resources with the appropriate knowledge about the specific technology being adopted can be beneficial, as is the use of internal audit to periodically review the overall progress of the implementation.

When it comes to potential talent challenges, companies should focus on finding and developing the right skillsets and capabilities, which may entail acquiring new talent or reskilling its workforce. Boards should make sure that the company is addressing the training and education needs required to analyze, adopt and integrate new technology.

Innovation Paving the Way

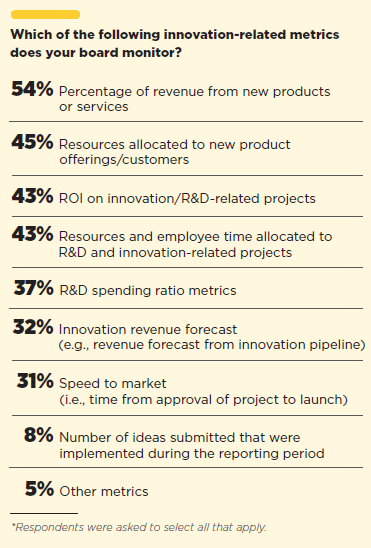

A company’s innovation process and approach should be specific to the company, its circumstances and its sector. In other words, companies should select innovation metrics that best reflect and align to their specific strategy and business context.

While there is no one-size-fits-all approach to which metrics boards should monitor, directors should ensure that their companies have initiatives that are appropriately balanced across three areas: new markets, new products and solutions, and efficiencies within their existing business model. According to our survey, revenue generated from new products and services ranks as the most common metric monitored by 54 percent of boards, followed by resources allocated to new offerings and innovation ROI.

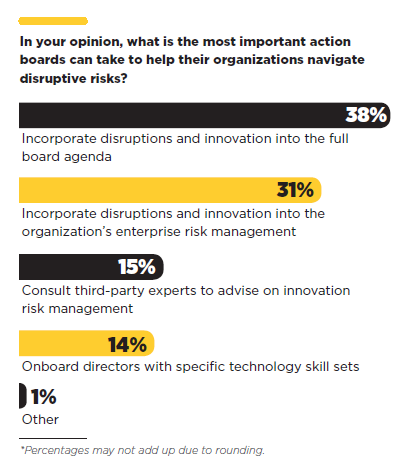

When asked what they believe is the most important action they can take to help their companies navigate disruptive risks brought on by technology, 38 percent of surveyed directors chose incorporating the topic of disruption and innovation into the full board agenda, while 31 percent say the most helpful would be to include these topics in the risk management process.

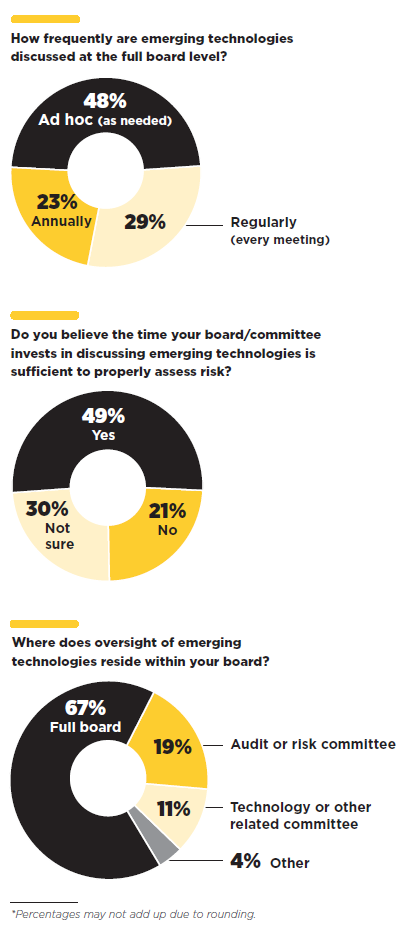

Making time to discuss issues related to emerging and disruptive technologies is critical; yet, only 29 percent of boards say their board discusses emerging technologies regularly. The remaining 71 percent say they either discuss it annually (23 percent) or on an ad-hoc basis (48 percent)—a frequency that once again has directors divided on whether it is sufficient to properly assess the growth opportunities and risks.

When it comes to the responsibility of oversight of emerging technologies, 67 percent say their full board takes this on rather than a stand-alone committee.

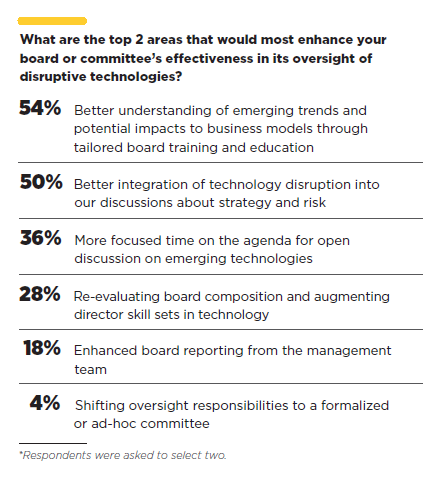

To help the full board gain confidence and support the integration of disruptive technology into their regular, ongoing strategy and risk discussions, directors must be committed to continual learning.

Directors should embrace a learning mindset, pursue educational opportunities, spend additional time with management and seek counsel from external experts or advisory panels as appropriate. This isn’t about making every director a technology expert. Rather, it is about increasing the board’s competency so that directors can ask thought-provoking and constructive questions of management.

Boards also need to be mindful of the limitations of appointing a specialist director as part of the solution. The responsibility for overseeing disruptive technology cannot be abdicated to one director, with the rest of the board relying on that individual’s briefings. A better practice is to upskill the full board to oversee both the opportunities and risks of emerging technologies.

Embracing the Disruptive Technology Frontier

The findings of this survey reveal clear opportunities for boards to strengthen their governance of disruptive technology. Boards can use independent data and resources to help identify potential disruption, validate existing strategic assumptions and challenge internal bias. They should verify that the implementation of disruptive technology includes an appropriate risk management process that aligns with the organization’s ERM framework. Boards can also pursue education and board refreshment to address knowledge gaps and help identify risks and any potential unknowns related to disruptive technology. Finally, they should strategically challenge whether the company has the right culture, skills and training required to succeed in this transformative age, and dedicate more time to the topic of innovation and disruptive technology during full board sessions.

Questions for the Board to Consider

- Is the board allocating sufficient time on its agenda, and is the committee structure appropriate to provide effective oversight of technological innovation and disruption?

- Does the board have the right mix of relevant skills, expertise, perspectives and experiences that allows for effective oversight of technological innovation and disruption?

- Which resources is the board using to keep abreast of technological trends, innovation and potential disruption?

- Is the board obtaining independent, external data and information that can be leveraged to gain insights and better evaluate emerging and disruptive risks?

- Have appropriate and meaningful innovation-related metrics been identified? If so, how often is the board reviewing these metrics?

- Are there any specific education and training topics that would enhance the board’s oversight of technological innovation and disruption?

Survey Methodology

In March and April 2019, Corporate Board Member and EY surveyed 365 public company directors to determine how disruptive technologies are impacting the boardroom. The survey was conducted online, anonymously.

Respondent Demographics

| Title/Role: | |

|---|---|

| Executive director | 4% |

| Independent director | 81% |

| Lead director | 9% |

| Board chair | 13% |

*Respondents were asked to select all that apply

| Market Capitalization: | |

|---|---|

| Less than $50 million | 4% |

| $50 million to $300 million | 10% |

| $300 million to $2 billion | 28% |

| $2 billion to $10 billion | 38% |

| $10 billion to $300 billion | 19% |

| $300 billion+ | 1% |

*Percentages may not add up due to rounding

| Sector: | |

|---|---|

| Financial Services | 24% |

| Technology | 15% |

| Consumer Products & Retail | 12% |

| Life Sciences | 9% |

| Real Estate, Hospitality & Construction | 9% |

| Automotive & Transportation | 8% |

| Power & Utilities | 7% |

| Health | 4% |

| Mining & Metals | 4% |

| Oil & Gas | 4% |

| Government & Public Sector | 2% |

| Media & Entertainment | 2% |

| Telecommunications | 1% |

*Percentages may not add up due to rounding

| Committee Seats: | |

|---|---|

| Audit/Risk | 64% |

| Nominating/Governance | 62% |

| Compensation | 55% |

| Other | 30% |

| Technology/Innovation | 10% |

*Respondents were asked to select all that apply.

| Tenure as a director of a publicly traded corporation: | |

|---|---|

| Less than two years | 6% |

| Three to five years | 13% |

| Six to ten years | 16% |

| More than ten years | 65% |