Fuente: Harvard Law School Forum on Corporate Governance and Financial Regulation

Autor: David F. Larcker and Brian Tayan (Stanford University)

Introduction

We recently published a paper, Paying a Pittance to the CEO: The American Public’s View of CEO Pay, that examines the American public’s view of CEO compensation. Among the controversies in corporate governance, perhaps none is more heated or widely debated across society than that of CEO pay. Americans might not have strong opinions about chairman independence, proxy advisory firms, staggered boards, or dual-class shares, but they almost always have an opinion (usually negative) about how much CEOs are paid. While researchers and practitioners argue over concepts of labor market efficiency, pay for performance, and shareholder alignment, to members of the public the issue of CEO pay boils down to a personal assessment of whether any executive deserves to be paid so much money.

That said, corporations are not monolithic entities. They vary by size, industry, and performance, and it is not practical to assume that CEOs—no matter what pay they are offered on average—will earn the same amounts in all circumstances. To the American public, how should pay vary with size and performance? Under what circumstances do CEOs deserve higher pay, and in those cases, how much higher should it be? When value is created, how much of that value should be paid as compensation, and what are the implications given the incredible size and market valuation of America’s largest companies?

To gain insight into these issues, the Rock Center for Corporate Governance at Stanford University conducted a survey of the American public asking their views on CEO pay. The views that American citizens have on CEO pay is centrally important because public opinion influences political decisions that shape tax, economic, and regulatory policy. These, in turn, have a significant impact on the incentives offered to senior executives who make the investment and capital allocation decisions that determine the productivity of the general economy and therefore the standard of living of average Americans.

Americans and CEO Pay

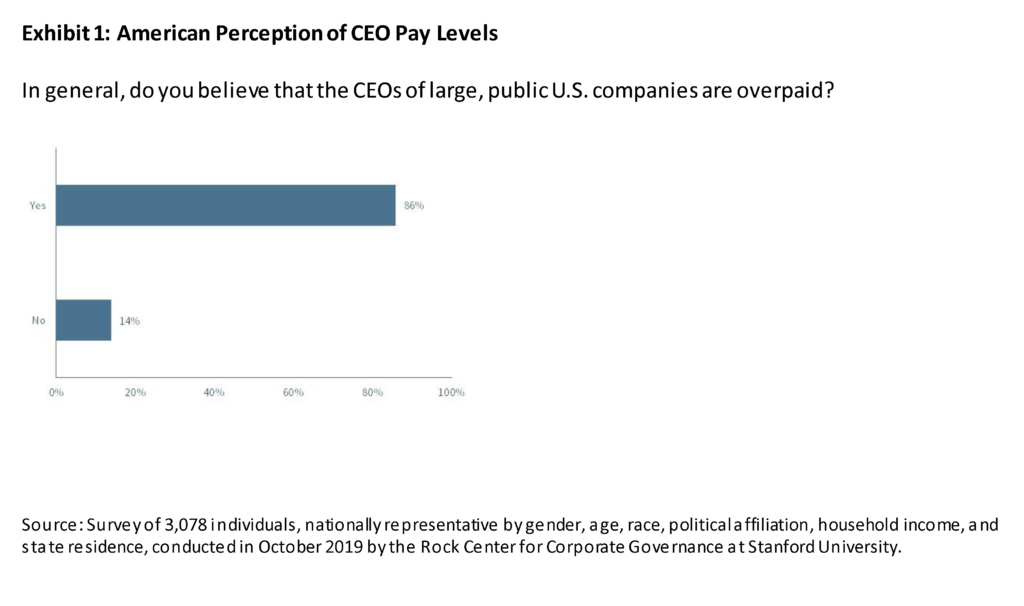

Not surprisingly, most Americans do not have a favorable view of CEO compensation. Eighty-six percent of respondents believe the CEOs of large, public U.S. companies are overpaid; only 14 percent do not. Responses are remarkably similar across political-party affiliation and household-income levels (see Exhibit 1). Responses are also stable over time. A 2016 survey by the Rock Center found that 83 percent of Americans believed CEOs to be overpaid relative to the average worker.

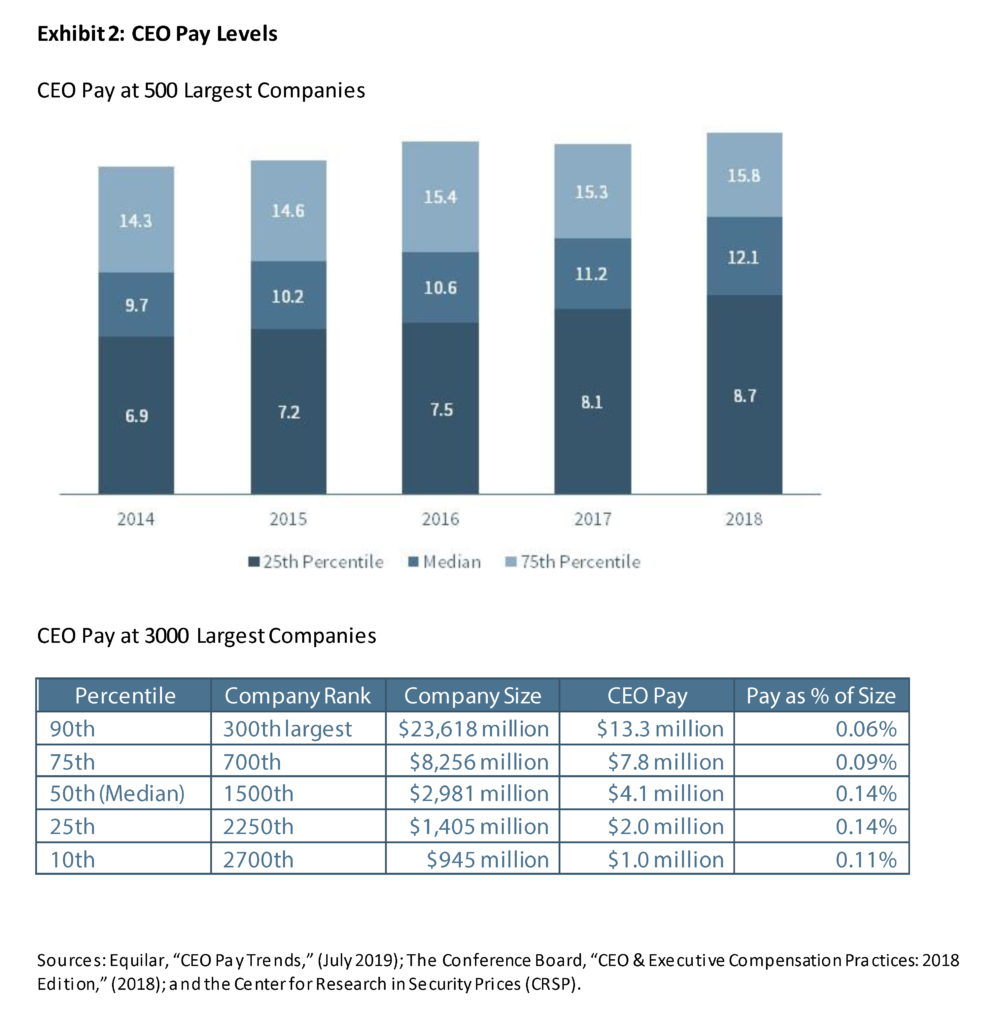

CEO pay, however, is not constant across companies. It varies based on size, profitability, and organizational complexity, and therefore we might expect that views of pay will depend on what company is being evaluated. For example, median total compensation among S&P 500 companies is $12 million, while median total compensation among Russell 3000 companies is a much lower $4.1 million. Within the Russell 3000, company market capitalization at the 90th percentile is $23.6 billion and CEO pay is $13.3 million; at the 10th percentile, those figures are $945 million and $1.0 million, respectively. That is, as company size increases 25-fold, pay increases 13-fold (see Exhibit 2).

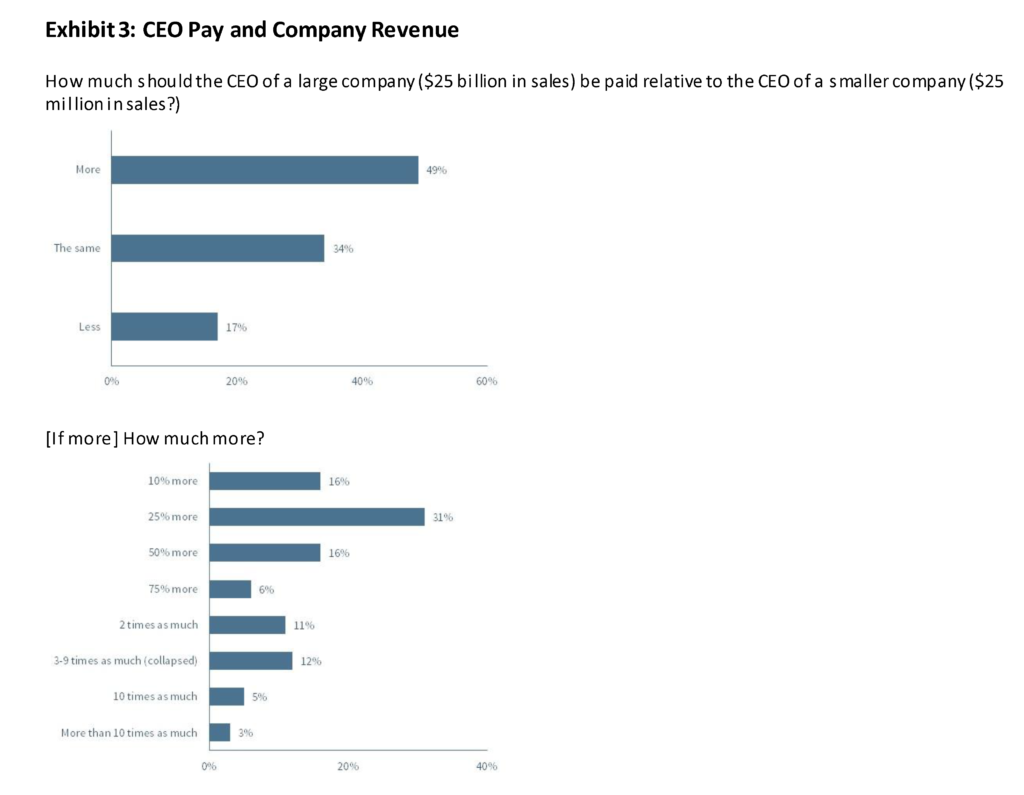

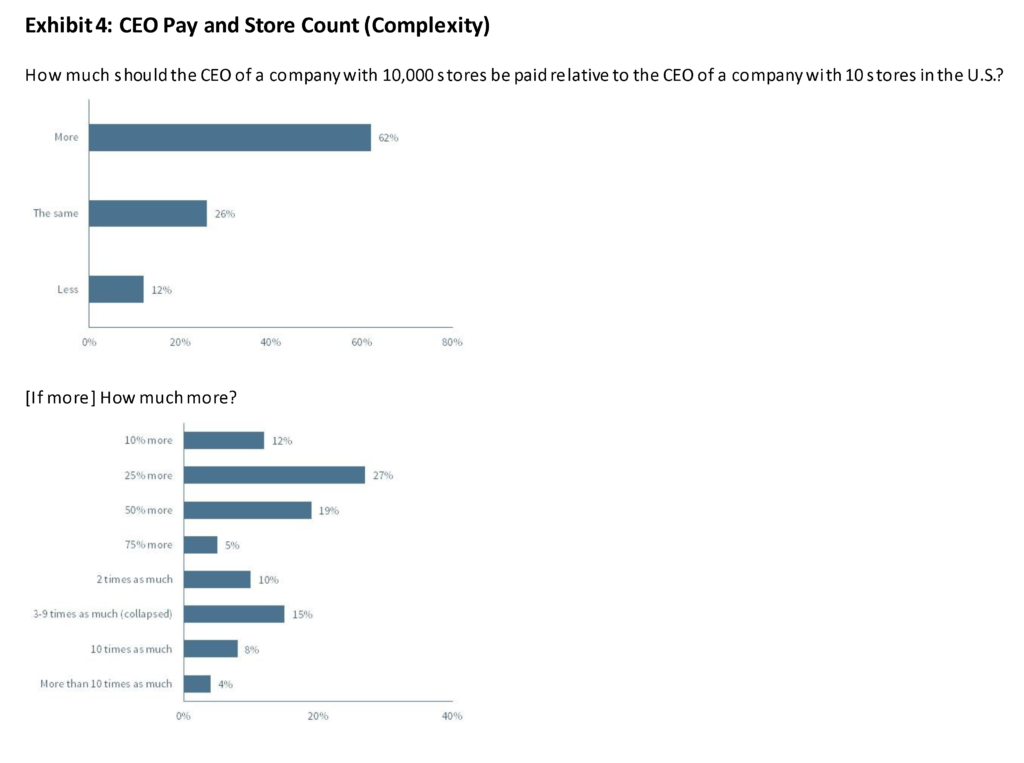

The typical American agrees that CEO pay should vary with company size. However, they believe the relation between size and pay should be much lower than it is in practice. For example, a typical respondent believes the CEO of a large company by sales ($25 billion) should be paid only 50 percent more than the CEO of a smaller company by sales ($25 million)—despite a 1,000-fold difference in revenue between the companies. Only 4 percent of Americans believe the CEO of the larger company should receive 10 or more times the compensation of the CEO of the smaller company (see Exhibit 3). Similarly, Americans believe the CEO of a company with 10,000 stores should be paid 50 percent more than the CEO of a company with 10 stores—also a 1,000-fold difference in size. Only 7 percent believe the CEO of the larger company should be paid at least 10 times more (see Exhibit 4). While the median results are the same in both scenarios, the distribution of responses is skewed higher in the second scenario, suggesting that size as measured by operational complexity (store count) is a more salient factor to Americans than revenue.

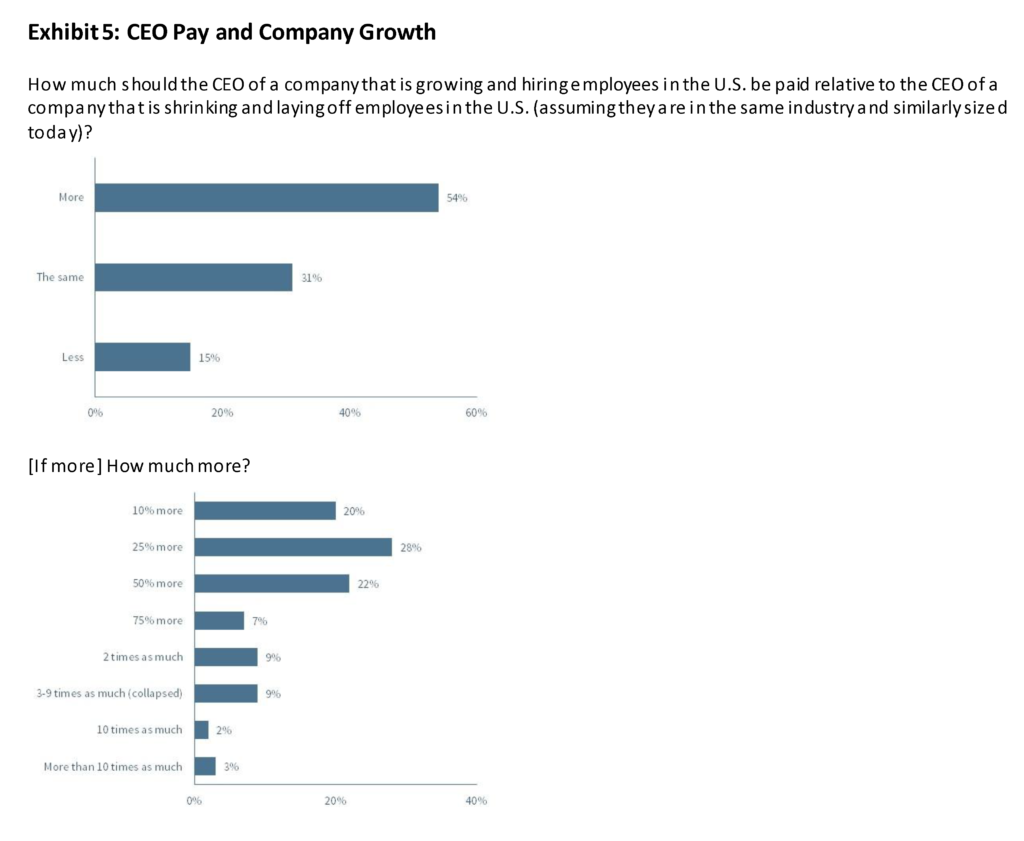

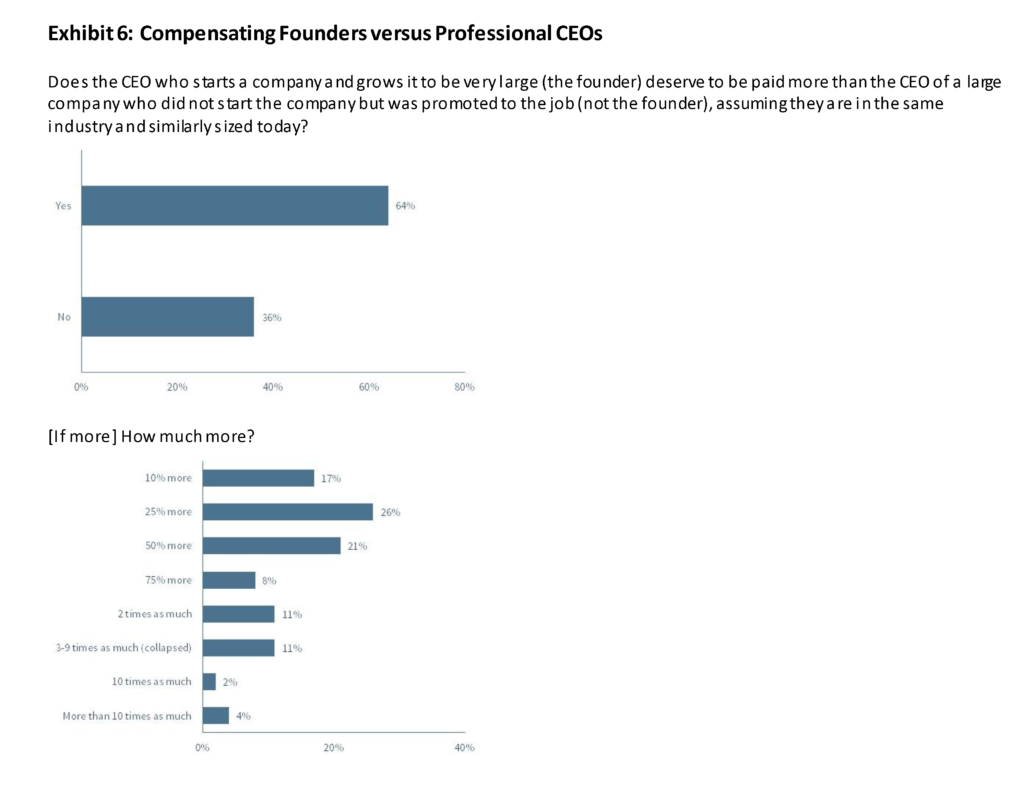

Furthermore, Americans believe that CEOs should be paid more for growth. Fifty-four percent believe the CEO of a company that is growing and hiring U.S. employees should be paid more than the CEO of a company that is shrinking and laying off U.S. employees (assuming they are in the same industry and similarly sized today), while only 31 percent believe they should be paid the same (see Exhibit 5). Similarly, two-thirds of Americans (64 percent) believe founders who have presided over the growth of their companies deserve higher pay than professional CEOs of similarly sized companies who are promoted to the job (see Exhibit 6). This suggests the public places a high value on the act of job creation in assessing CEO pay, which of course directly affects the economic prospects of workers.

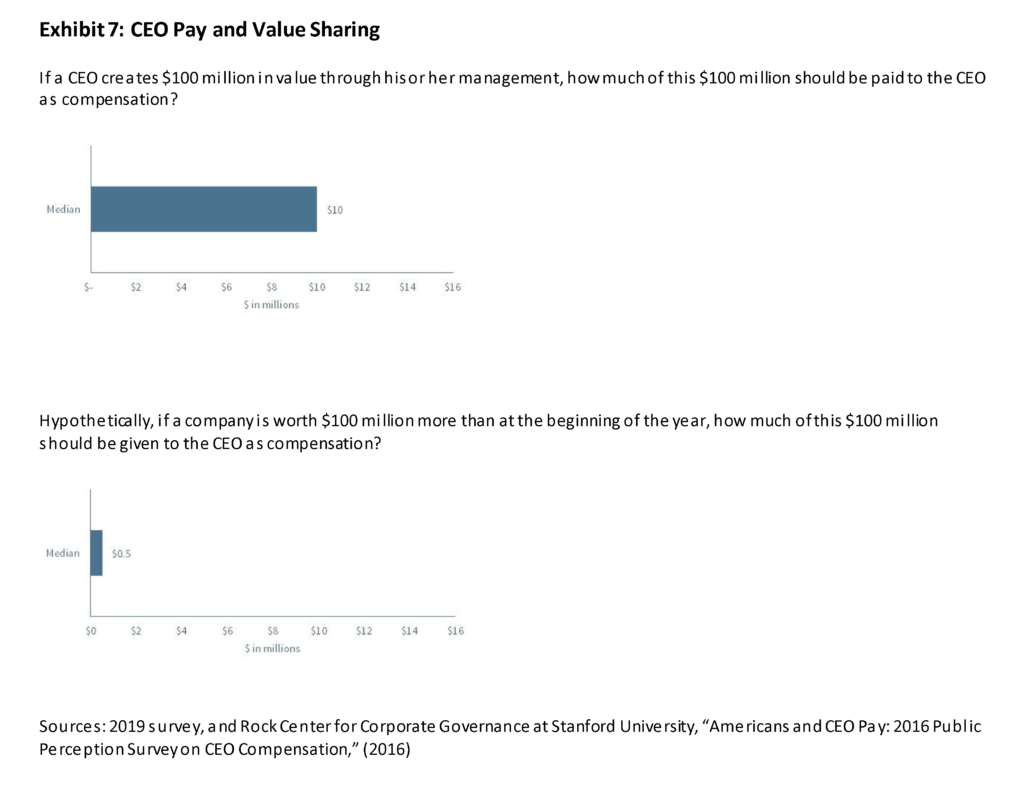

Still, the disconnect between observed pay levels and the public’s view of pay is stark. Prior studies find that CEO pay increases approximately $0.3 for every $100 change in shareholder wealth, but the public believes it should increase only $0.05 for that same change. This might be due to the fact that the public views compensation changes through the economic practices that exist across the bottom and middle of most organizations, where promotions are compensated with 10 percent, 15 percent, and 20 percent raises, rather than the economic practices that we witness at the top of organizations where compensation scales significantly with size and profitability. Alternatively, it might be that Americans do not believe CEOs are responsible for much of the value creation at their companies. To this end, when given a hypothetical situation of a CEO who creates $100 million in value through his or her management, respondents are willing to share $10 million, or 10 percent of this value in compensation (median response). However, when asked about a company that is simply worth $100 million more at the end of the year than at the beginning of the year, respondents are willing to give only $500,000 as compensation, implying that CEOs are responsible for only 5 percent of value creation (see Exhibit 7). The research evidence on this question is very mixed. Prior studies conclude that CEOs are responsible for as little as 4 percent and as much as 36 percent of company performance. Corporate directors estimate that CEOs are responsible for 40 percent of performance.

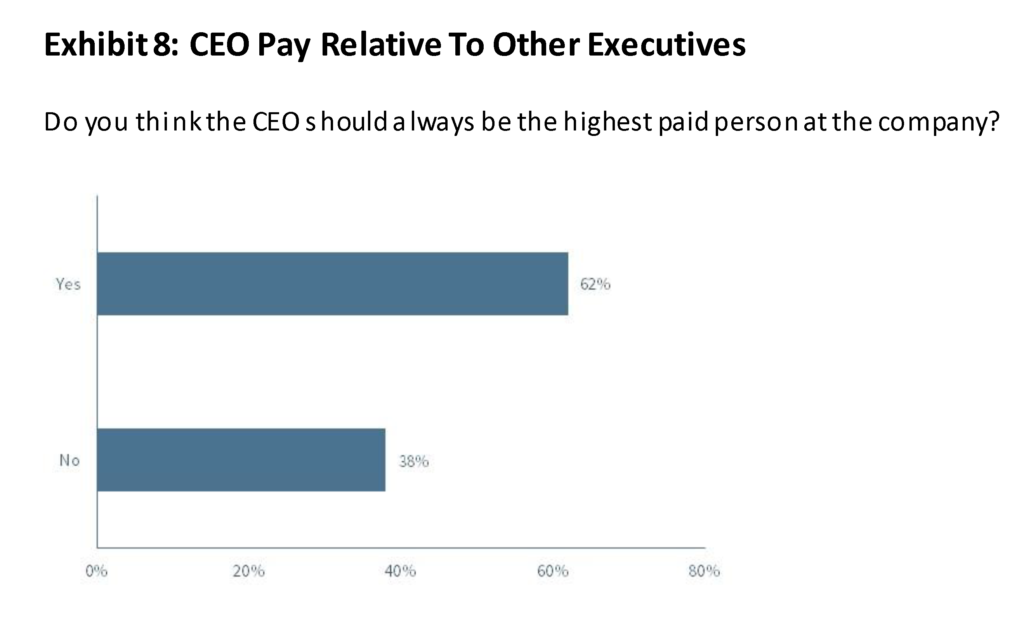

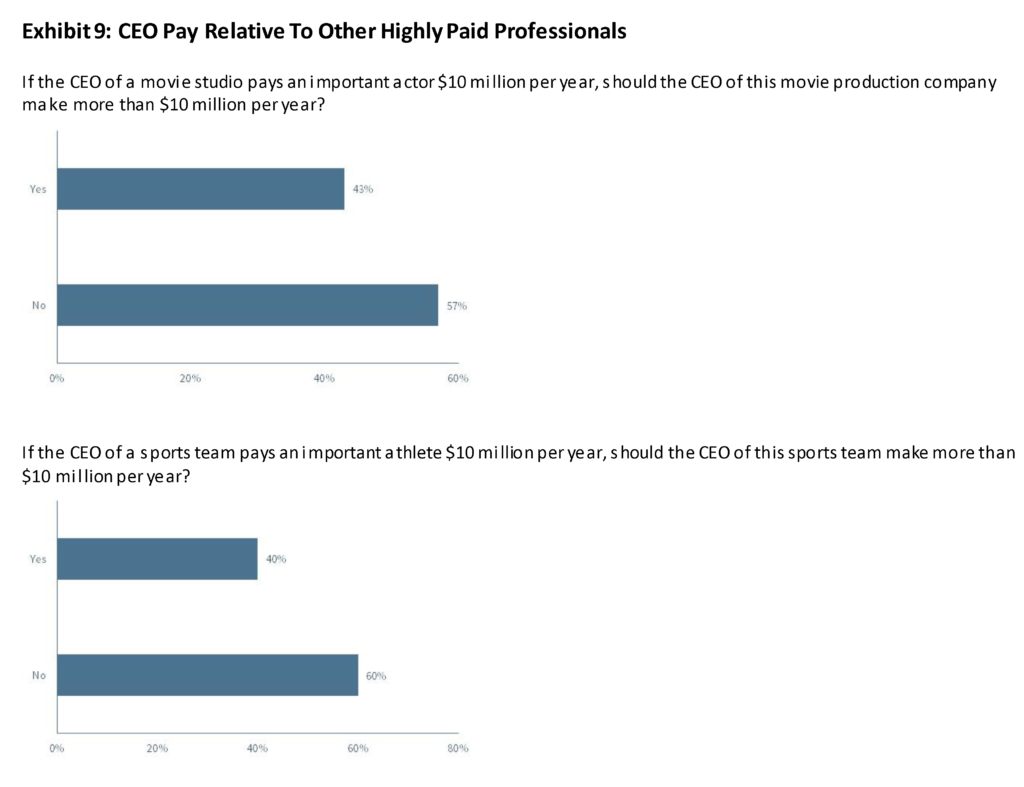

Americans also hold varying opinions about how CEOs should be compensated relative to other highly paid professionals. Sixty-two percent of the public believes the CEO should always be the highest paid person in a company, whereas 38 percent do not (see Exhibit 8). However, only 43 percent believe the CEO of a movie studio should make more than $10 million per year if an important actor at that movie production company makes $10 million per year; and only 40 percent believe the CEO of a sports team should make more than $10 million if an important athlete on that team makes $10 million per year (see Exhibit 9). That is, many Americans believe other individuals within an organization can be responsible for a larger portion of value creation than the CEO, although opinions on this question are mixed.

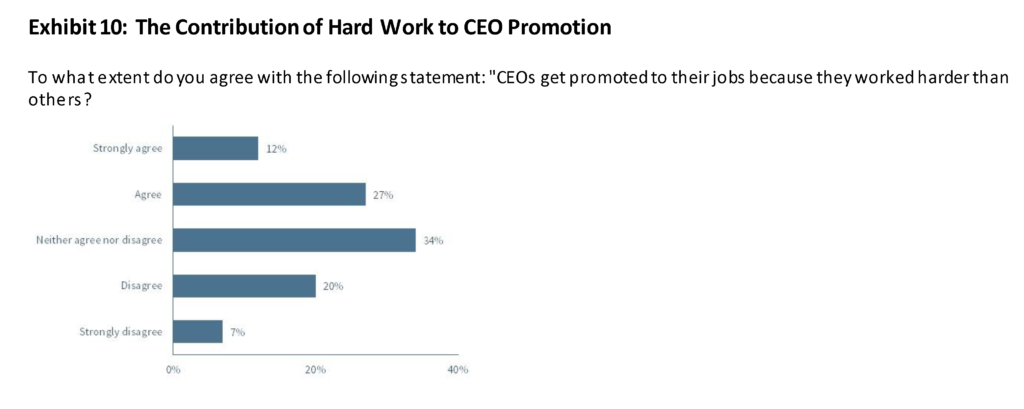

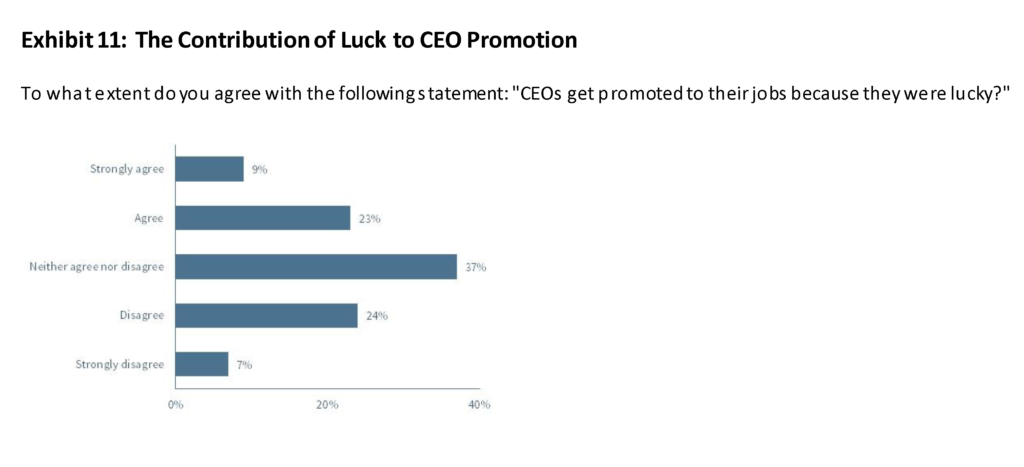

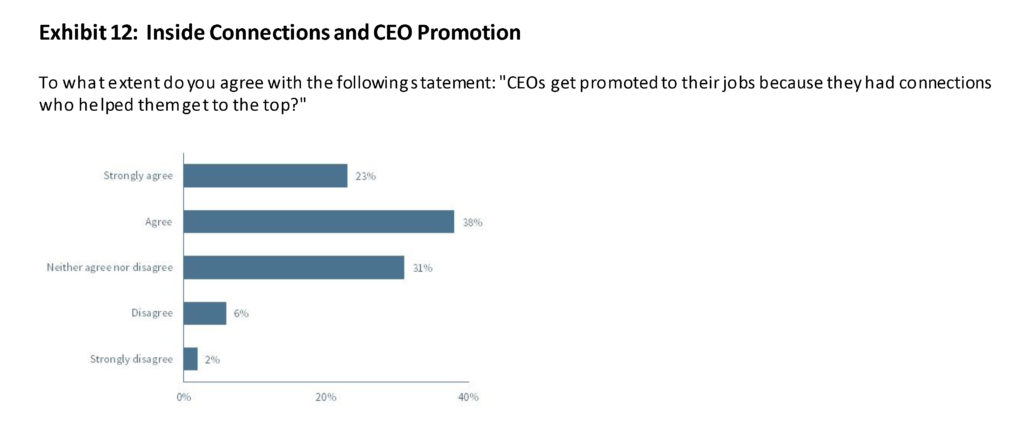

The public is also divided over the extent to which CEOs are promoted because of effort, luck, or connections. That is, what fundamentally drives the career success of the CEO? Thirty-nine percent believe CEOs are promoted because they worked harder than others, while 27 percent disagree. Thirty-two percent believe they were promoted because they were lucky; 31 percent disagree. And an overwhelming percentage (61 percent versus 8 percent) believe CEOs had connections who helped them get to the top (see Exhibits 10-12).

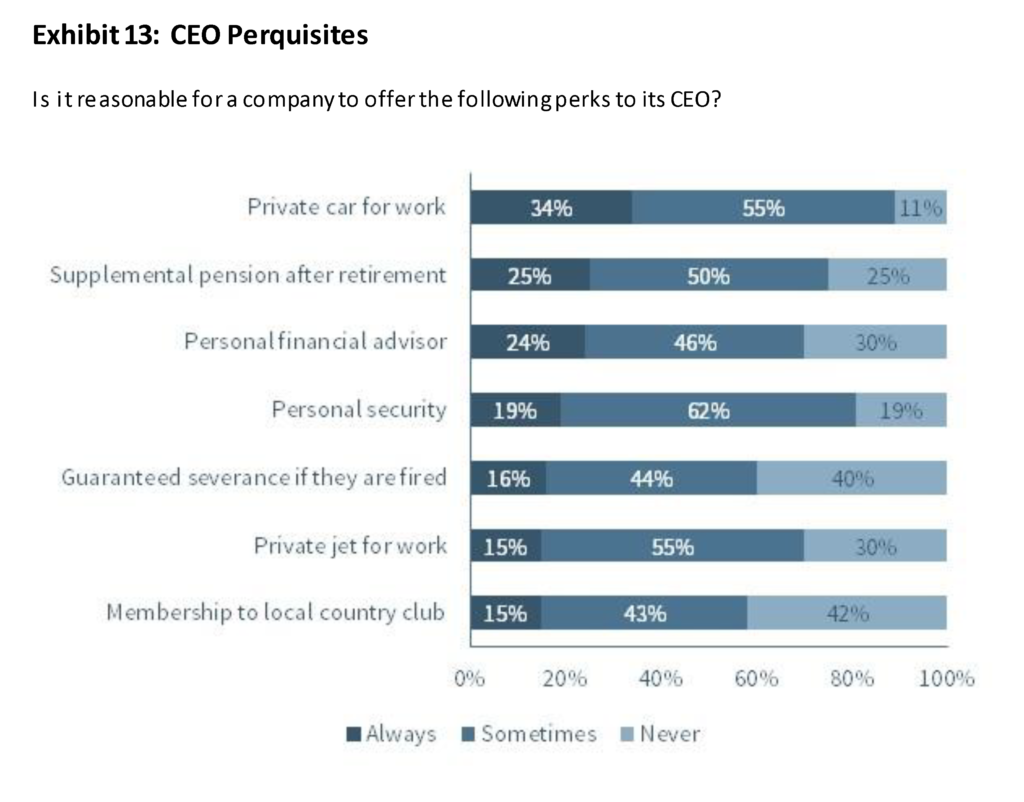

While the American public is critical of CEO pay levels, they are much less critical of CEO perquisites. The majority of Americans believe it is reasonable to provide the CEO a wide variety of perks, including a company-provided private car or jet for work, personal financial advisor, personal security, supplemental pension, guaranteed severance, and membership to a local country club. Among these, the use of a private jet for work is considered the most reasonable, and guaranteed severance and country club membership are considered the least reasonable. Surprisingly, the seemingly controversial issue of using a private jet for work ranks in the middle in terms of appropriateness: 70 percent say it is always or sometimes appropriate to provide a private jet for work travel, while only 30 percent say this perk should never be provided (see Exhibit 13).

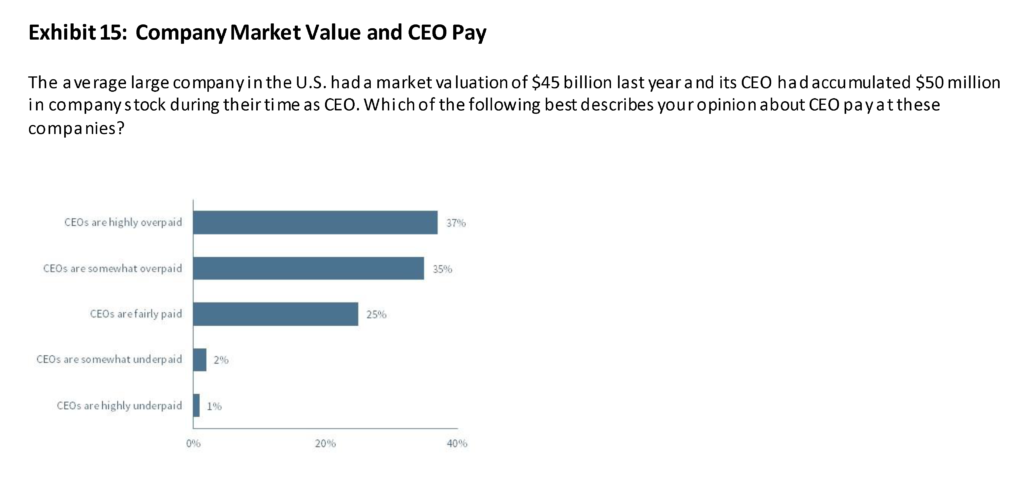

Opinions of CEO pay become only modestly more favorable when respondents are given actual data about the size and profitability of the average large U.S. company and the amount of pay and accumulated equity that CEOs have earned at these firms. When told that the average large company in the U.S. earned $2 billion in profit last year and its CEO was paid $12 million, only 70 percent believe CEOs are overpaid—a 16 point improvement over the unprompted question (see Exhibit 14). When told the average large company has a market value of $45 billion and its CEO accumulated $50 million in company stock over their career, 72 percent say CEOs are overpaid (see Exhibit 15).

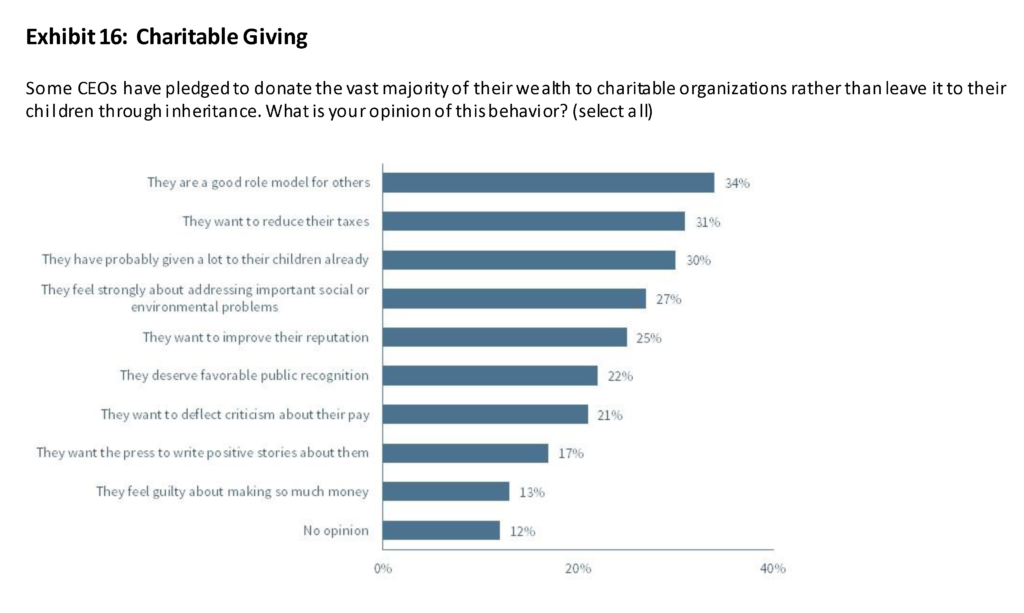

Finally, in recent years several wealthy executives have pledged to donate large portions of their accumulated wealth to charitable organizations, rather than leave it to family members at their death. To test whether the public’s view of CEO pay is moderated based on these practices, we asked Americans for their opinion of CEOs who donate much of their wealth. Responses are mixed, including equal parts admiration and cynicism. For example, respondents are as likely to say CEOs who donate most of their wealth are a good role model for others (34 percent) as they are to say CEOs just want to reduce their taxes (31 percent). They are also as likely to say CEOs donate their wealth to charity because they feel strongly about addressing important social or environmental problems (27 percent) as they are to say that CEOs have probably already given a lot of money to their children (30 percent). A large minority (25 percent) say that CEOs who donate their wealth do so to improve their reputation.

Why This Matters

- Survey data of the American population shows widespread negative perceptions of CEO pay, due in part to the common belief that CEOs are not responsible for significant portions of the value creation and performance of their companies. Are these views wrong? Or are the corporate directors who approve pay levels wrong? How can our understanding of pay and value be improved and the controversy over CEO pay resolved? How might companies effectively communicate that CEO pay is really due to shareholder wealth creation and employment growth by the CEO?

- The American public understands that CEO pay is, and should be, related to the size, growth, and value of companies. However, they disagree about the degree to which pay should scale with size—i.e., “how much more.” In general, how should the level of CEO pay rise with complexity and profitability, particularly among America’s largest corporations? Is there a point at which CEO pay should simply stop increasing? Or does the basic economic principle of value sharing continue to apply no matter the scale of the company?

- Considerable political pressure exists to “reform” CEO pay. How should political implications, if at all, be factored into CEO pay decisions? Should pay be reformed in the boardroom, or should high pay levels be addressed solely through the tax code?

- Cynicism runs through the survey data cited in this post. The public not only expresses unfavorable views about CEO pay, but they also express healthy degrees of cynicism about how CEOs get their jobs (hard work versus luck and connections) and about CEOs who donate their wealth (to help society or for tax and reputational benefits). Are the negative views of CEO pay driven in part by a broader skepticism or lack of esteem for CEOs? Or do high pay levels themselves contribute to lower regard for CEOs?

The complete paper is available for download here.