Fuente: Harvard Law School Forum on Corporate Governance

Autor: Friso van der Oord, NACD

Key Findings

- Public companies face a conundrum navigating two divergent business forces. Directors identify growing business-model disruptions (52%) and a slowing global economy (51%) as the top trends most likely to impact their organization over the next 12 months. While not contradictory, these divergent trends create a challenge for many companies: how to balance a growth and disruption mind-set to stave off competition with preparations for the impact of a potential recession.

- Public companies must also confront growing friction between the need to (digitally) innovate and the effective management of cyber risks. Sixty-one percent of directors report that they would be willing to compromise on cybersecurity to achieve business objectives, while 28 percent prioritize cybersecurity above all else.

- For most companies, current strategies will become irrelevant in the next five years. Sixty-eight percent of responding directors report that their company can no longer count on extending its historical strategy over the next five years. Future growth will likely depend on the adoption of a different business model and an entirely new set of assumptions about what success will look like.

- Boards seek to improve their effectiveness in core oversight areas, but don’t believe they need to spend more time in these areas. The majority of directors seek to improve core oversight activities over the next year: strategy execution (63%), strategy development (61%), and cybersecurity (60%). Yet, more than 70 percent of directors believe they already spend enough meeting time on each of these topics. This suggests that to improve in these areas, boards must maximize the return on the time that the board spends together and with management and consider changing existing oversight practices.

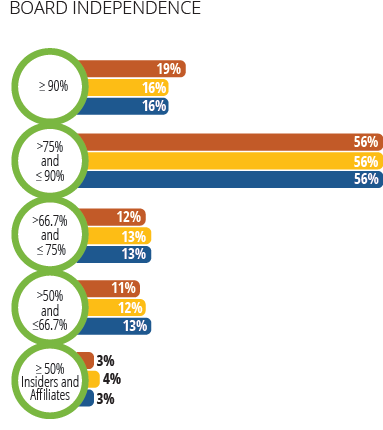

- More and more women are joining boards; however, that progress is happening at a slow but steady pace. Between 2017 and 2019, the percentage of women on Russell 3000 boards rose from 15 to 19 percent. Most of this growth is explained by an increasing number of women serving on boards of mid- and large-cap organizations rather than small- or mega-cap ones, as mega-cap companies already tend to have high percentages of women while small-cap companies have been slow to embrace this trend.

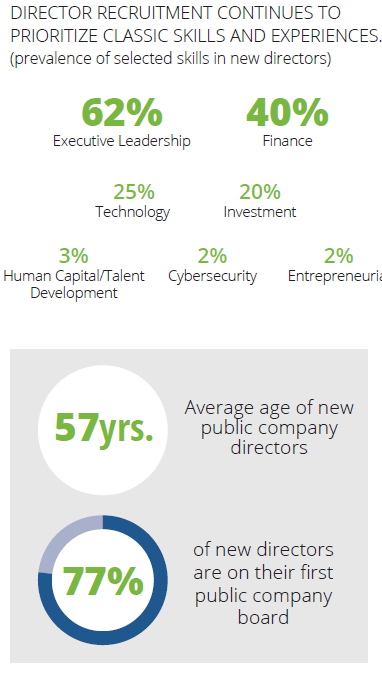

- Board refreshment in the past year continued to focus on candidates with traditional skills, such as executive leadership (60%) and finance (40%). However, skills areas that support growing business needs are often neglected. Skills and backgrounds in areas such as entrepreneurship, cybersecurity, and human capital were present in just 2 percent of new directors respectively.

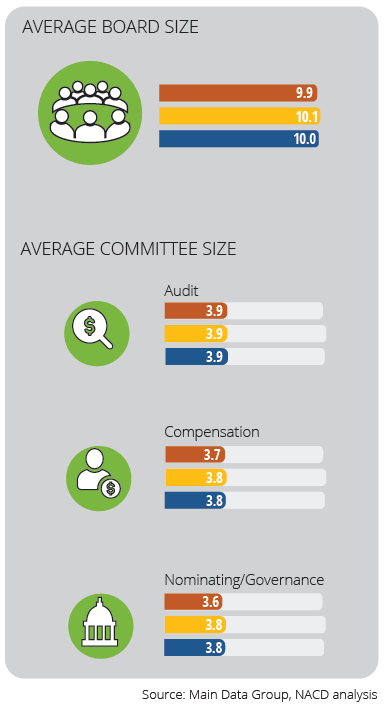

- Board-committee structures, outside of the three standing committees, remained largely the same over the past three years. This is despite a growing emphasis on issues such as digital innovation and transformation; cybersecurity; environmental, social, and governance (ESG) issues; human capital; and innovation, which have not yet led to the widespread establishment of additional board committees.

- Board oversight of human capital is maturing. Most directors (77%) are comfortable with oversight of current and future talent needs; just 43 percent have reviewed charters to ensure that talent oversight responsibilities are effectively allocated across the board. Finally, only 34 percent have set clear expectations for what the board requires from management.

- ESG is becoming commonplace in the boardroom, although more work remains. Nearly 80 percent of public-company boards now engage with ESG issues in some meaningful way. Most focus on ensuring linkages to strategy and risk. Discussions with investors often center on elements of the S, with an emphasis on human capital (65%) and diversity (74%).

Board Structure Snapshot

Board Renewal in the Russell Index (Since 2018)

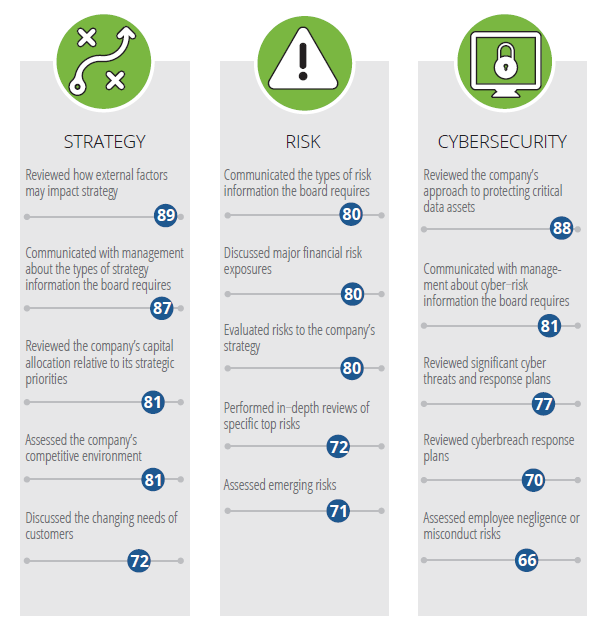

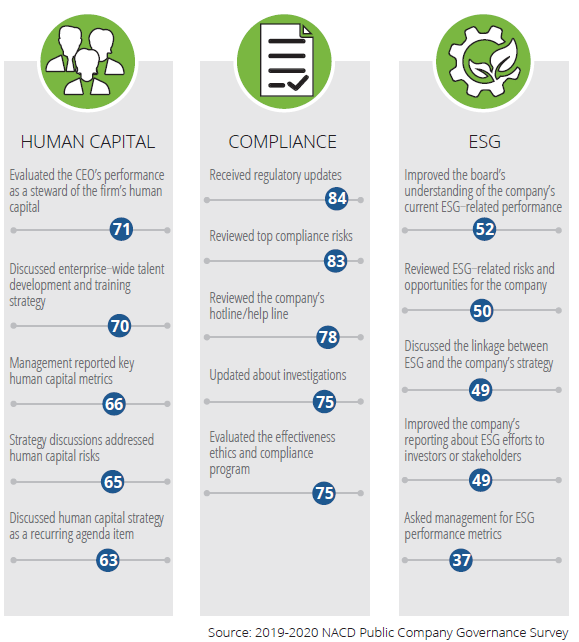

Board Oversight Snapshot

The most common board oversight practices in six major governance areas as reported by respondents to our survey (percentage of boards)

Board Priorities

Trends

Boards Confronted with Increasingly Divergent Trends

Key Finding

More than half of public-company directors rank these three trends in their top five issues most likely to impact their organizations in 2020: growing business-model disruptions (52%), a slowing global economy (51%), and increased competition for talent (50%). These trends suggest that boards and their management teams could soon face the strategic challenge of addressing two mounting, but starkly different, threats. Firms must continue to invest in their own transformation to ensure both their company’s long-term success and their ability to compete for scarce talent, while their organizations must brace themselves for the impact of a potential recession.

Why It Matters

The twin and simultaneous threats of a potential downturn and potentially destructive business-model disruption create a major conundrum for organizations. More active board engagement may be needed to help management reconcile these two seemingly conflicting imperatives: being recession-proof and innovation-ready.

Guidance for Boards

To navigate this conundrum, more proactive, continuous involvement of the board in shaping the strategy may be needed, recognizing a need for more frequent course corrections as conditions change. The board should work with management to create a shared picture of the present (the next 12 months) and the future (the next five years), to understand where the markets, industry, and competition are heading, and what that means for strategy and growth prospects. Tools and tactics to do so can be found in the Report of the NACD Blue Ribbon Commission, Fit for the Future: An Urgent Imperative for Board Leadership.

Areas for Improvement

Increasing Board Time Commitment May Not Improve Governance of Key Issues

Key Finding

The majority of responding directors report that it is important for their board to improve performance in traditional areas of oversight, such as strategy execution (63%), strategy development (61%), and cybersecurity (60%). Somewhat contradictorily, these are also areas in which nearly two-thirds report spending enough board time, suggesting that devoting more time to these areas will yield little improvement in board oversight. However, activities that could enhance board performance in these areas fall toward the bottom of the list of current improvement priorities.

Why It Matters

Rather than finding more time on already busy meeting agendas, boards should seek to maximize the return on the time that the board spends together and with management. That includes optimizing board-meeting management, taking a strategic approach to time allocation, and revisiting board structure.

Guidance for Boards

Improvements in meeting management, such as minimizing time allocated for formal presentations and better use of one-on-one time between the board and the CEO, can create the opportunity for more productive dialogue on critical matters. Another area for improvement could be broadening the range of management voices that the board hears from: boards can insist on hearing more from the internal auditor about risk-management effectiveness, for example. The Report of the NACD Blue Ribbon Commission, Fit for the Future: An Urgent Imperative for Board Leadership elaborates on these practices for enhancing meeting effectiveness.

Board Oversight Activities

Strategy

The Challenge of Replacing Obsolete Strategies

Key Finding

In response to the disruptive and simultaneous forces impacting their companies, directors recognize that management strategies now need to change more quickly. Sixty-eight percent of responding directors believe that their company can no longer count on extending its historical strategy over the next five years. It is therefore no surprise that 83 percent of directors now indicate that their boards are proactively engaged with the strategy-development process. And 89 percent of boards review the impact of shifting external factors and pressure test assumptions.

Why It Matters

The speed of technology change, major turbulence in geopolitics, and the nimbleness of competitor—among other factors—make it more difficult to get strategy right. At the same time, given the growing expectations of stockholders and other stakeholders, the stakes are higher than ever before. This means that boards feel more urgency to challenge management’s thinking and decision making, and when appropriate, more urgency to act as a thought partner with management to craft strategy and respond to disruptions.

Guidance for Boards

Board leaders can drive strategic board renewal by ensuring that the skills of directors in the boardroom correspond to the evolving needs of the organization. The board plays an important role in ensuring that management frequently reassesses key strategic assumptions and maintains critical alignment between a shifting strategy and key levers of that strategy, such as organizational incentives, risk management, and talent needs. The Report of the NACD Blue Ribbon Commission on Adaptive Governance: Board Oversight of Disruptive Risk offers directors and board leaders actionable guidance on how to improve their oversight of strategy formulation.

Enterprise Risk

Work to Be Done to Ensure Clear and Timely Risk Information

Key Finding

Risk information is often well presented, but boards are less certain that they have the right information to make informed decisions. Just 56 percent of responding directors believe the information presented allows the board to draw the right conclusions. Boards hear about risk largely from the CEO and chief financial officer, but only 51 percent of boards hear from the head of internal audit, who is the independent voice to help assure that risks are well-managed in the organization.

Why It Matters

Risk oversight has matured over the years, but information asymmetry—the gap between what the board knows and what management knows—remains a challenge for boards. In a fast-moving risk environment, boards require clear and timely risk information to draw the right conclusions and ask management the right questions. Backward-looking risk information or information that is focused on well-known risks must be balanced with forward-looking risk reports that allow directors to peek around corners to understand emerging threats.

Guidance for Boards

Boards may consider conducting off-cycle calls with management and participating in regular, deep-dive reviews with business leaders for more granular, forward-looking, and timely insights into key risks. Additionally, boards should seek new ways to leverage technology and analytics tools to increase transparency and reduce dependence on interpretations by senior leaders. The Report of the NACD Blue Ribbon Commission on Adaptive Governance: Board Oversight of Disruptive Risk provides further guidance.

Cybersecurity

Three in Five Directors Would Prioritize Business Objectives Over Cybersecurity

Key Finding

Directors hold divergent views as to the relative importance of ensuring cybersecurity versus the pursuit of growth. Sixty-one percent of directors don’t believe that cybersecurity should get in the way of business operations. Conversely, 28 percent choose to prioritize cybersecurity, even at the cost of potential business gains. Directors are more confident in their organizations’ ability to mitigate cyber risk. Enhanced management reporting and greater transparency may have contributed to directors’ increased confidence in their organization’s ability to effectively respond to a material cyber incident. This year, 66 percent of directors reported greater confidence, up 16 percentage points from last year.

Why It Matters

Boards face a conundrum in balancing important cybersecurity concerns with continued pursuit of digital innovation, transformation, and ultimately corporate growth. They and their management team need to carefully assess how much cyber risk they are willing to accept in order to pursue their overall strategy. They also need to prepare themselves to address the growing friction between the goals of data protection and privacy versus data mining to extract business insights.

Guidance for Boards

Directors and boards can turn to the NACD Director’s Handbook on Cyber-Risk Oversight to enhance their oversight practices. To ensure that the right balance is maintained, directors should review NACD’s report on Governing Digital Transformation and Emerging Technologies. This guide assists boards in their governance of major technology investments and innovations.

Human Capital

Boards Confident in Human Capital Oversight, Less Certain About Workforce Readiness for the Future

Key Finding

Human capital is increasingly seen as a critical driver of long-term value by both investors and boards. Nearly three-quarters of directors now believe that they individually, and their boards collectively, understand the company’s talent needs well enough to provide effective oversight. Most directors indicate primary reliance on reporting from the CEO (93%) and heads of human resources (77%). Only 43 percent of boards have reviewed their committee charters to ensure that human capital oversight is properly organized, and just 34 percent have given management clear expectations about reporting to the board on human-capital-related issues.

Why It Matters

Boards are still maturing their oversight approach in this new area. Effective human capital management is a key lever for companies to meet their current and future strategic objectives. Unfortunately, the skill sets demanded by new strategies often do not exactly match firms’ existing talent pool. More than a third of directors surveyed cannot affirm that their organizations are currently well-positioned to effectively develop a workforce that is fit for the future.

Guidance for Boards

Boards should expand the discussion of human capital strategy and risk to ensure that it is aligned with the overall strategy-development process. They should consider updating their governance guidelines and committee charters to formalize human capital oversight responsibilities. Boards may also seek to expand the set of voices reporting on talent issues from across the organization in areas such as information technology, audit, and operating business units, to get a broader view into talent-related issues. NACD’s recent advisory council report on Board Oversight of Human Capital Strategy and Risks provides boards with actionable guidance on how to improve their oversight of human capital.

Compliance

Directors Believe That Their Companies Have Strong “Speak-Up” Cultures

Key Finding

The vast majority of responding directors, 89 percent, now believe that they have enough insight into their company’s ethics and compliance programs to say that it is more than just a check-the-box exercise. Further, 82 percent report that their organizations possess strong “speak-up” cultures, where employees feel comfortable raising concerns about alleged misconduct.

Far fewer boards have taken action to build compliance expectations into incentives for senior management (37%) and only half of them monitor third-party compliance risk (51%), a growing source of risk exposure for companies that is increasingly difficult to control given outsourcing all along the supply chain.

Why It Matters

In many ways, corporate compliance has become more challenging. New technologies and business models raise different compliance and ethics challenges in areas like data privacy. Meanwhile, regulations are proliferating and sometimes even diverging globally, while companies’ conduct is now exposed almost instantaneously through social media. Moreover, the continued emphasis by the US Department of Justice on the effectiveness of compliance and ethics programs in preventing, detecting, and mitigating the risk of individual wrongdoing is raising the bar for companies’ compliance efforts.

Guidance for Boards

Directors should regularly assess the effectiveness of their company’s compliance and ethics programs, and their company’s ability to adapt to shifting requirements across the globe. In an environment where companies receive significant punishment for ethical missteps, boards should ask management which business practices—even those that are legal—may become unacceptable in the next year, and ensure that conversations about corporate conduct and reputation are clearly linked to the strategic decision-making process. Director Essentials: Strengthening Compliance and Ethics Oversight offers strategies and tools to do so.

ESG

Boards Are Starting to Formalize Their Oversight of ESG Issues

Key Finding

Boards are starting to take ESG concerns seriously and are improving their understanding of ESG issues. Seventy-nine percent of directors reported that their board is focused on some aspect of ESG. Perhaps not surprisingly, they are focused on improving their understanding of ESG and how it materially contributes to value preservation and creation. More than half of respondents (52%) continue to seek ways to improve their own understanding of ESG performance. Half of directors report assessing ESG in relation to risk and opportunities for the company and discussing the links between ESG and strategy.

Why It Matters

ESG issues are growing in importance for a wide variety of stakeholder interests. Large investors and stakeholders expect to see how boards are overseeing relevant ESG matters. This includes identifying relevant ESG-related risks and opportunities. This pressure to disclose ESG-related information likely pushed improving external reporting as a higher priority for boards in 2019, up 33 percent compared to 2018. Boards that remain silent will have their company’s ESG story told by third-party raters and rankers.

Guidance for Boards

To provide effective oversight, boards need to ensure a common definition of ESG across the organization. This definition should be used by management to identify and prioritize ESG risks and opportunities and it should be presented to the board in the context of the company’s strategy. Guidance is available in NACD’s handbook, Oversight of Corporate Sustainability Activities.

Investor Scrutiny Influences Boards’ ESG Agendas

Key Finding

Directors ranked human capital management (65%) and diversity (54%) as the top ESG concerns for their organizations. These are largely driven by investor scrutiny, as evidenced by the presence of both diversity (74%) and human capital (65%) as the two top ESG issues boards discussed with investors. Recognizing this increased investor focus, 49 percent of boards are working to improve reporting and 61 percent have open discussions about the most-material ESG matters when they meet with investors.

Why It Matters

Large investors and stakeholders expect to see that boards are actively engaging management on ESG-related issues. Although companies already conduct many activities underlying the E, S, and G headings, boards play a critical role in ensuring a consistent, more strategic, enterprise-wide ESG approach that is linked to long-term value creation, can be audited, and is effectively reported.

Guidance for boards

Directors should ensure that their company selects the most appropriate external standards framework for ESG reporting. This can help ensure that ESG is not just a greenwashing, public-relations exercise, but is tied into the effective strategy making and risk management that contribute to long-term value creation. Guidance is available in NACD’s handbook, Oversight of Corporate Sustainability Activities.

* * *

The complete report, including graphs and appendix, is available here.