Fuente: S&P Global

Autores: Corinne B Bendersky, Michael T Ferguson, Noemie De La Gorce, Bruno Bastia

The coronavirus pandemic has rapidly spread across the globe, creating a once-in-a-generation public health catastrophe. It has upended the global economy, plunging even the most prosperous countries into recession. It’s exposing vulnerabilities in value chains, revealing the depth of corporate values, and prompting coordination and collaboration not seen since war-times. Financial markets have been roiled as investors seek to identify the companies that are best positioned to weather a crisis of this magnitude and as governments develop strategies to rescue beleaguered sectors. With a long recovery ahead, it’s clear that few sectors and companies will be spared the consequences. The impacts are both direct and indirect, and most certainly enduring.

With the unprecedented disruption being wrought by this pandemic, companies across the economy will be forced to closely manage their social and human capital and scrutinize their strategies as well as their readiness for “black swan” type risks, which are rare, difficult to predict, and result in severe outcomes that typically exceed expectations. However, even if this pandemic is without precedent, the fallout from it could precipitate a more acute focus on environmental, social, and governance (ESG) factors and preparedness for attentive leadership teams. In S&P Global’s view, strong ESG performers with stakeholder-focused and adaptive-governance structures are likely to remain resilient amid these rapidly changing dynamics. This commentary will explore in detail the ways in which ESG issues are heightened by the pandemic.

We expect governments around the world will step in, to some degree, to buoy the most visibly affected industries, but the social ramifications are rippling across sectors and will likely carry with them consequences that aren’t immediately apparent. Our ESG Evaluation considers near-term measurable risks such as changing consumer behavior like cancelling vacations or avoiding restaurants and sporting events due to social distancing. But it also considers less tangible, reputational impacts: for instance, the good will a utility might generate by extending favorable payment terms to its most vulnerable customers or the community benefits an industrial company might reap by repurposing its production facilities to develop personal protective equipment. By contrast, a company could face backlash from layoffs or exposing employees to the virus. Additionally, we consider the extent to which a company’s fortunes are affected by the region in which it operates–obviously, demographics and geography can influence the spread of the virus, but companies will also be subjected to the various government actions and reactions. And while the social factors may appear more urgent, there are still environmental and governance implications emanating from this extraordinary upheaval.

Here, we explore the ESG implications of COVID-19 through the lens of S&P Global’s ESG Evaluation Profile framework to outline the factors at play during this unprecedented time.

An ESG Birdseye View Of The Pandemic

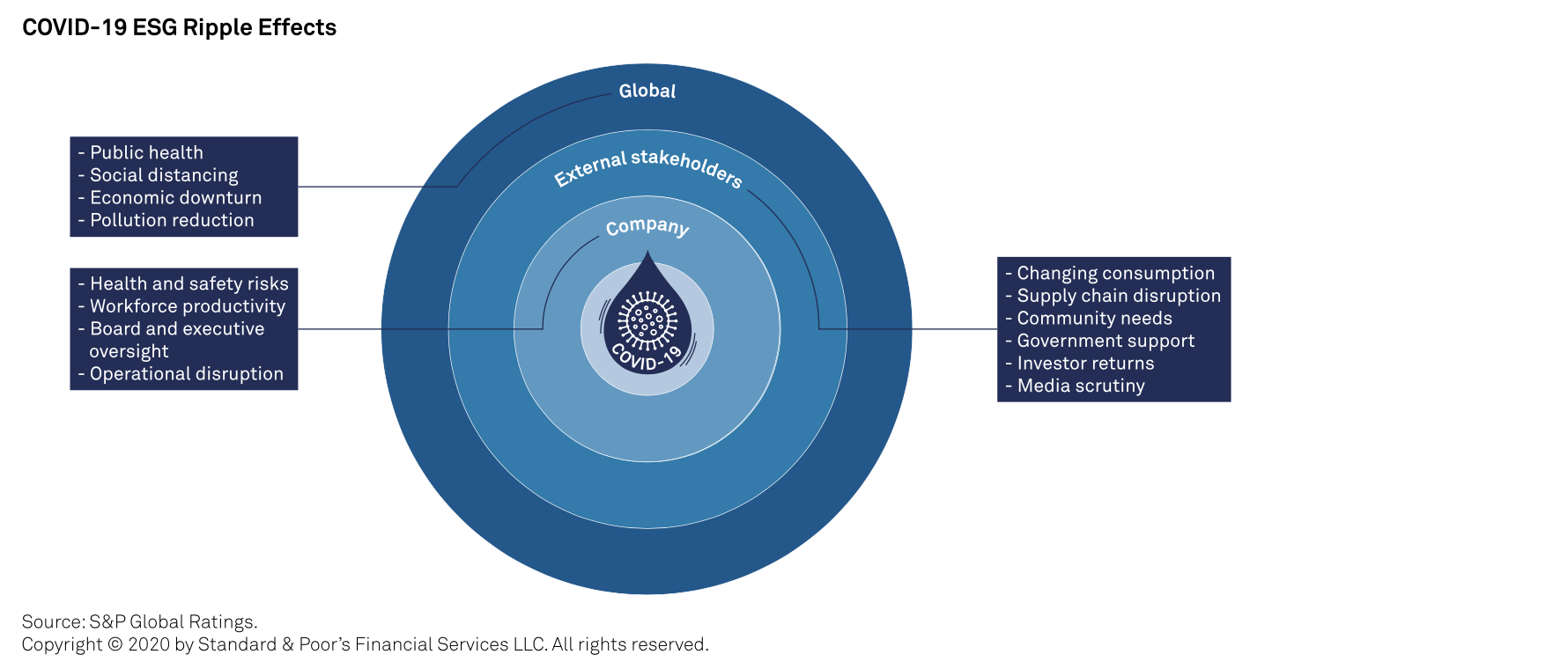

The COVID-19 pandemic illustrates the materiality of environmental and social risk factors, along with the importance of strong governance. Since the beginning of the outbreak, health and safety considerations, which we view as a social factor, have guided many business decisions that have potential financial and reputational consequences. Disruptions in operations, supply chains, policy responses, and customer behavior will have financial consequences, while damage to a company’s reputation could stem from changes in what is perceived as socially acceptable by stakeholders. For example, some construction companies have come under scrutiny for requesting employees to commute to construction sites despite the potential threat to their workers’ health & welfare and the risk of exacerbating community spread. The pandemic is a reminder that health and safety are key concerns across all industries, and mismanagement can have a significant impact.

The current pandemic also illustrates the potentially disruptive nature of some emerging environmental and social risks due to the encompassing global dimension, unprecedented policy response, and rapid and severe tumultuous effects on economies. It’s affecting companies as well as stakeholders across the value chain, including employees, contractors, suppliers, consumers, and local communities, among others. While disruptions caused by emerging social and environmental risks are difficult to predict, we believe some, including those associated with climate change, represent similar systemic risks because they could disrupt economic systems across industries, value chains, and regions.

Though we’re still in the early days of the pandemic, we’re beginning to see that some management teams have successfully navigated the short-term challenges. Longer term, though, we believe that companies with stakeholder-focused governance, may be better equipped to adapt for two reasons:

- The threat of pandemics isn’t new. The World Economic Forum has identified “infectious diseases” and pandemics as one of the main global risks in its annual Global Risk Report since it was first published in 2006. Companies that routinely assess long-term and emerging risks as part of their risk management may be better positioned to anticipate them, prepare adequate contingency plans, and remain resilient to them over the long run.

- Sustainability risks, including social and health risks, affect a broad set of stakeholders across the value chain, from suppliers to employees, customers, and governments. Companies that regularly engage with their relevant stakeholders may be better positioned to adequately respond during a pandemic and defend their social license to operate than companies that haven’t fully assessed the ecosystems in which they operate.

The “S”: Social Distancing And Beyond

This pandemic is illustrating the significance of social and human capital and how they support well-functioning companies. This includes responsiveness to worker health and safety, adaptability to changing customer dynamics, effectiveness in managing wildly altered workforce conditions, and the level of support for local community and societal needs. It’s also demonstrating the trade-offs that entities must consider when balancing the needs of their many stakeholders, which in some cases may be in conflict. For instance, companies are confronted with decisions like upholding employee health and safety while simultaneously maintaining continuity to meet customer demands. The following sections describe in detail how this pandemic is influencing each of the ESG Evaluation Social Profile’s four factors and the considerations that underpin our analysis of an entity’s social performance.

Health and safety

Customers

- Many companies have had to rapidly change their customer engagement model to adapt to social distancing policies while ensuring business continuity and customer safety. For example, food retailers had to ramp up food supply and capacity for home delivery, while limiting customer foot traffic in stores to avoid transmission. Some companies have gone a step further and provided financial support to some of their customers experiencing a temporary drop in income from the economic slowdown by offering grants and loans. In any case, transparency and communication have often played an important role in maintaining customer satisfaction as customers seek to limit disruption and request more reliable services and products.

- Data protection and cybersecurity represent critical risks, in particular in the health care sector where data is playing a crucial role to improve scientific knowledge about the virus, while also providing guidance for policy response. As a result, organizations handling health-related data may be increasingly exposed to potential data breaches, as shown by the recent failed cyberattack on Paris Hospitals. Risks to customer data may also be exacerbated as organizations expand working remotely, increasing the pressures on a given information technology (IT) systems.

We will monitor companies’ abilities to preserve their customer experience in this fast-moving climate. We expect management of customer satisfaction and information to remain demanding during the pandemic as customers quickly adapt their consumption habits to the rapidly evolving situation. We also believe that resuming normal activities may prove even more difficult. Risks will range from potential supply disruption as the supply chain restarts, to long-lasting changes in customer behavior. Those risks could be exacerbated by periods of release alternated with lockdown periods, although they could also bring opportunities for the most nimble companies.

Workforce and diversity

The main focus of our workforce and diversity analysis is the extent to which entities are supporting a long-lasting, productive, and inclusive workforce. To that end, the pandemic is creating severe disruptions in how workforces are operating in the short run, which could result in enduring changes in workplace culture. Workforce characteristics will influence how entities respond and perform throughout this crisis. Critical service providers in the care and service industries, particularly health care and food retail, place their staff at greater health risk, which could result in strikes and labor disputes in the event of mismanagement, lack of sufficient health benefits, poor direct managerial support, insufficient protective supplies, and perceived deprioritization of worker demands. Any one or a combination of these factors could lead to possible operational disruption and damaged reputations. Industrial service providers also face operational disruptions if remote controls are unavailable or insufficient. Nonessential service providers that fail to suspend operations may also damage their reputations.

Entities with white collar workforces are mandating their employees work from home, which requires sufficient technological and broadband capabilities to enable business continuity. The extent to which entities can smoothly facilitate this transition will influence overall workforce productivity. Indeed, the pandemic may expose entities that have technical and operational deficiencies to prolonged disruption. Moreover, this shift blurs the line between work and home and could hurt employee productivity depending on the suitability of employee “home office” setups; especially where employees must balance work with care responsibilities, particularly for children, elders, and/or people with disabilities.

Mismanagement during the crisis could also influence retention rates, leading to higher levels of voluntary turnover, requiring costly and time-consuming re-hiring and training. Major layoffs could also scar reputations and furloughs could mar employee goodwill, while entities that provide income protection, job guarantees, and expanded sick leave may see their reputations boosted. With skills shortages becoming an increasingly important business concern, any controversies related to workforce mismanagement could influence talent recruitment and thereby interfere with the execution of strategic priorities. Additionally, as supply chains are disrupted, the ways in which entities consider and support the workforce conditions of their suppliers will influence supplier relationships and ultimately influence supply chain integrity in the long run.

Our assessment of these factors also considers context. The severity of impact on the workforce and supply chains will depend on legislation and other jurisdictional protections. Entities operating in territories where governments provide workforce protections to stave off layoffs will benefit, while others will have to confront tough tradeoffs. Because this is a public health crisis, it has also shined a spotlight on sick leave coverage and those entities that exceed local social standards, particularly in jurisdictions with limited protections, may reap reputational benefits. Moreover, an entity’s financial health is an important consideration, and the extent to which a business can sustain salaries amid deteriorating market conditions is also at play. Overall, entities that demonstrate strong workforce management by listening and responding to staff needs may generate goodwill, which could improve workforce productivity, loyalty, and recruitment in the long run.

Communities

This pandemic has made clear the value that entities can provide to communities by engaging and responding to stakeholder needs. While community engagement efforts typically emphasize localities, the pandemic has elevated the concept of the global community and the needs facing our global society. When assessing an entity’s community engagement, our ESG Evaluation analysis incorporates the extent to which it listens to community needs and focuses on relevant strategic investments, resources, and expertise linked to core business competencies.

The coronavirus has led to alarming shortages in essential equipment and goods such as personal protective equipment, ventilators, and disinfectants, which are essential to protect frontline workers and the public health at large. Entities that respond to these needs by repurposing or retooling their factories and operations, are able to generate community goodwill, resulting in reputational benefits that are likely to persist long after the crisis abates. This has involved garment manufacturers pivoting resources and mobilizing teams of seamstresses to ramp up production of protective masks, gowns, and scrubs for health care workers. Even vacuum manufacturers have leveraged their experience building motor-driven gadgets to design and manufacture ventilators. This can also involve support that responds to second-order community needs that are arising from lockdown orders, such as for virtual education capabilities.

Community engagement also involves marshalling financial resources to contribute to community needs, including investing in and funding scientific research for a COVID-19 vaccine, testing kits, and providing income support for beleaguered industries. Moreover, the ways in which entities effectively collaborate in multi-stakeholder initiatives and even directly coordinate with competitors to share their expertise and intellectual resources will also support their community reputation. Our analysis incorporates the magnitude of support provided as an indicator of how substantial these contributions are to communities. And while these community engagement efforts can focus on the global community given the global nature of the pandemic, there’s also localized support that entities provide, through, for example, building quarantine facilities in areas hardest hit by the virus. The analysis also reflects how an entity’s community efforts compare with peers in their industry, and there can, in some cases, be a greater reputational benefit from being at the forefront.

Conversely, entities that appear to be seeking profit in this crisis by withholding critical supplies or price gouging will face reputational damage. We monitor the ways in which entities consider how they can use their resources to help or hamper the needs of communities, how weighty their efforts are, and what the reputational implications for their brands may be. There’s also spillover from other community-based social factors including how sick leave protections (which we consider a workforce and diversity component) could present public health risks to communities. Indeed, reputational damage could accrue where communities attribute outbreak clusters to specific companies.

The “G”: A Litmus Test For Good Governance

Crises are the ultimate test for companies’ management and oversight bodies. More than just governance, exceptional times call for exceptional leadership. In our ESG evaluation, under the structure and oversight factors, we look at the quality of board structures and composition, oversight capabilities, and effectiveness. Though management is on the frontline dealing with the problems and a company’s risk management team are the “first responders,” the board remains ultimately responsible and accountable for how organizations deal with the issues at hand. Dedicated board-level crisis or risk committees can help define a company’s response; however, the magnitude of this situation requires the entire board’s efforts. Boards play a central role in steering companies, particularly in times of crisis, and may need to oversee management more closely than usual. Besides providing guidance to executives, board members are legally liable for management’s behavior and may face lawsuits if its response is inadequate or if they fail to exercise their fiduciary duty of oversight.

Moreover, crises often bring out the best and worst in people. Never has this been truer than today, looking at the distinctly different ways management teams the world over have been dealing with their workforce and communities. This pandemic may provide insight into how effective an entity is at defining and instilling coherent values across its operations, elements we consider in our code and values analysis. Once again, boards must play a crucial role here to ensure the company stays on course in terms of purpose and mission. We also consider the adjustments to executive remuneration. In recent days, several companies have announced they would cut executive pay or limit dividends because of the ongoing crisis. Typically, bonuses and variable pay were either cancelled or postponed, while the fixed pay of senior executives, and CEOs in particular, were significantly reduced. In many instances, such moves were prompted by financial necessity as a cost-cutting measure, while in other cases, it was implemented to show solidarity with the rest of the workforce, especially in companies in which job security is in jeopardy. Our analysis incorporates how company governance responses help or hinder its reputation, which now, more than ever, is under scrutiny. And finally, this pandemic is shining a light on how adeptly leadership teams maintain operational continuity. Those entities that face more prolonged disruptions than their peers do expose their governance shortfalls.

The “E”: Environmental Risk In A Time Of Uncertainty

In our view, most companies will experience COVID-19-related environmental implications indirectly. We may see improvements in environmental performance metrics by some entities in their next reporting cycle. This includes lower air pollution and greenhouse gas emissions from suspended manufacturing and production, reduced energy demand, and travel cancellations. While the overall amount of waste generated may also decline, we may see a rise in medical and hazardous waste, including single-use plastic equipment, in light of the increased demand for health services, which will require effective management by waste services companies. However, these conditions are likely to be temporary and performance is likely to revert to normal when business-as-usual resumes unless policy-makers intervene and/or a fundamental shift in consumptive patterns persists.

With that said, there may be some instances of entities deferring their environmental commitments or delaying construction of green projects to contend with liquidity shortfalls. If the pandemic and the attendant economic consequences prompts entities to defer their strategic environmental priorities, we could see deterioration in environmental performance. Additionally, changing market conditions, such as the decline of CO2 prices in the EU’s emissions-trading scheme, may also influence price incentives for environmental initiatives, which could lead to deferred asset upgrades or environmental investments. Regulatory interventions will also influence environmental performance and, where regulations being eased or new regulations delayed to accommodate beleaguered sectors, we may see environmental performance metrics either stagnate or deteriorate.

Pandemic Pandemonium

This pandemic is showing just how connected we are as a global society and how ESG risks can very quickly propagate throughout the worldwide economic system. At this time, it’s difficult to predict how an unprecedented event such as this will ultimately change businesses, governments, and societies at large. But it’s clear that as much of the world is locked down, this collective experience could reshape the economic system in profound and lasting ways, from how we travel to how we work and what we consume. It’s presenting opportunities to reorient company relationships with governments and technology, fundamentally shift business culture, and elevate trust and faith in scientific expertise. But just as every person is susceptible to contracting this virus, no corporate entity is immune to economic consequences this pandemic has wrought. The pandemic is becoming the ultimate litmus test not only of an entity’s financial health but also for its true commitment to ESG.

In the second report in this series, we’ll examine how companies prepare for disruption amid a crisis without parallel.

Related Research

- ESG Evaluations Remain Unchanged For Now In Light Of COVID-19, April 8, 2020

- Environmental, Social, And Governance Evaluation Analytical Approach, April 12, 2019

- How To Navigate The ESG Risk Atlas, April 11, 2019

- How We Apply Our ESG Evaluation Analytical Approach, April 10, 2019

- The ESG Advantage: Exploring Links To Corporate Financial Performance, April 8, 2019