Fuente: Graduate School of Stanford Business

Autor: ,

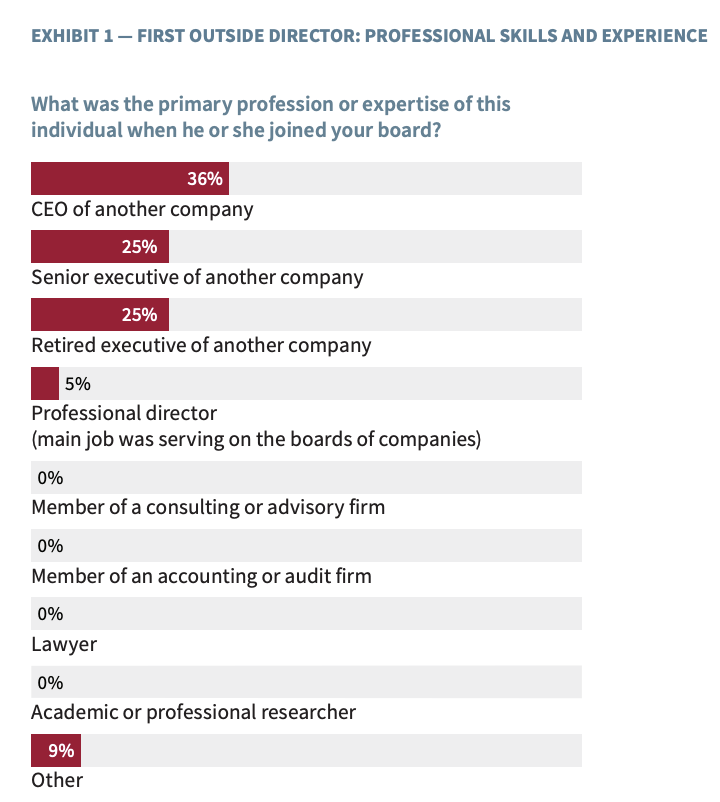

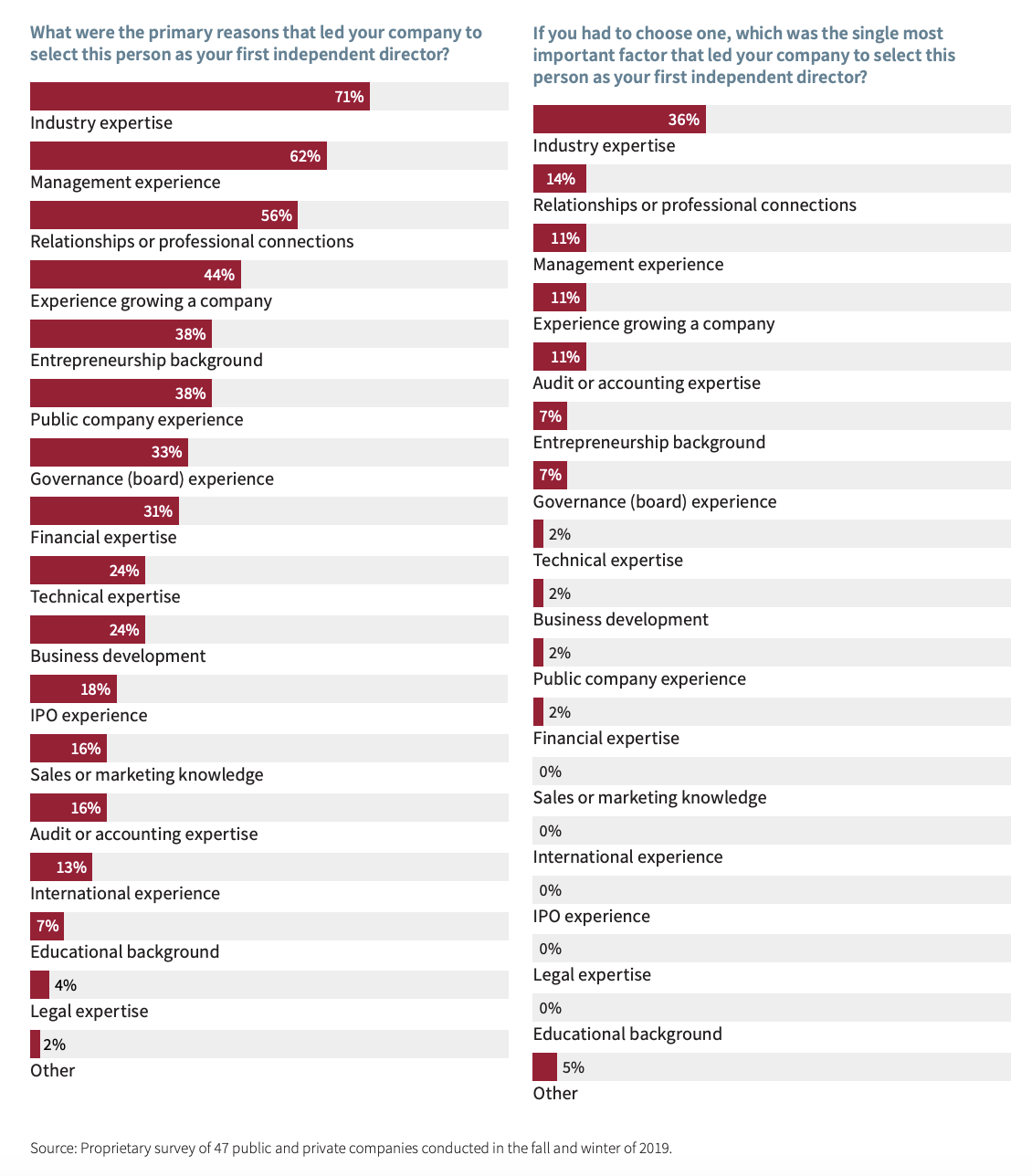

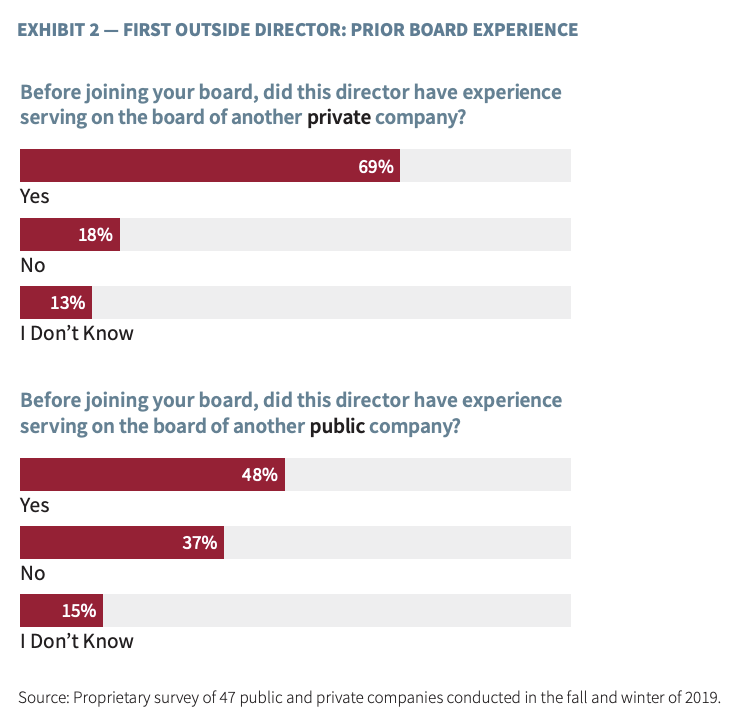

Little is known about the process by which pre-IPO companies select independent, outside board members — directors unaffiliated with the company or its investors. Private companies are not required to disclose their selection criteria or process, and are not required to satisfy the regulatory requirements for board members set out by public listing exchanges. In this Closer Look, we look at when, why, and how private companies add their first independent, outside director to the board.

We ask:

- Why do pre-IPO companies rely on very different criteria and processes to recruit outside directors than public companies do?

- What does this teach us about governance quality?

- How important are industry knowledge and managerial experience to board oversight?

- How important are independence and monitoring?

- Does a tradeoff exist between engagement and fit on the one hand and independence on the other?

HAZ CLICK AQUÍ PARA VER Y DESCARGAR LA PUBLICACIÓN EN PDF: “THE FIRST OUTSIDE DIRECTOR”