Fuente: Corporate Board Member

Autor: Melanie C. Nolen director of research for Chief Executive Group

Director optimism dipped slightly in July under the weight of inflationary pressures, continued labor shortages and potential tax, interest rate and regulation increases. Directors say they are concerned things might get worse before they get better, as they weigh the impact further lockdowns in the U.S. and across major international markets would have on the bottom line.

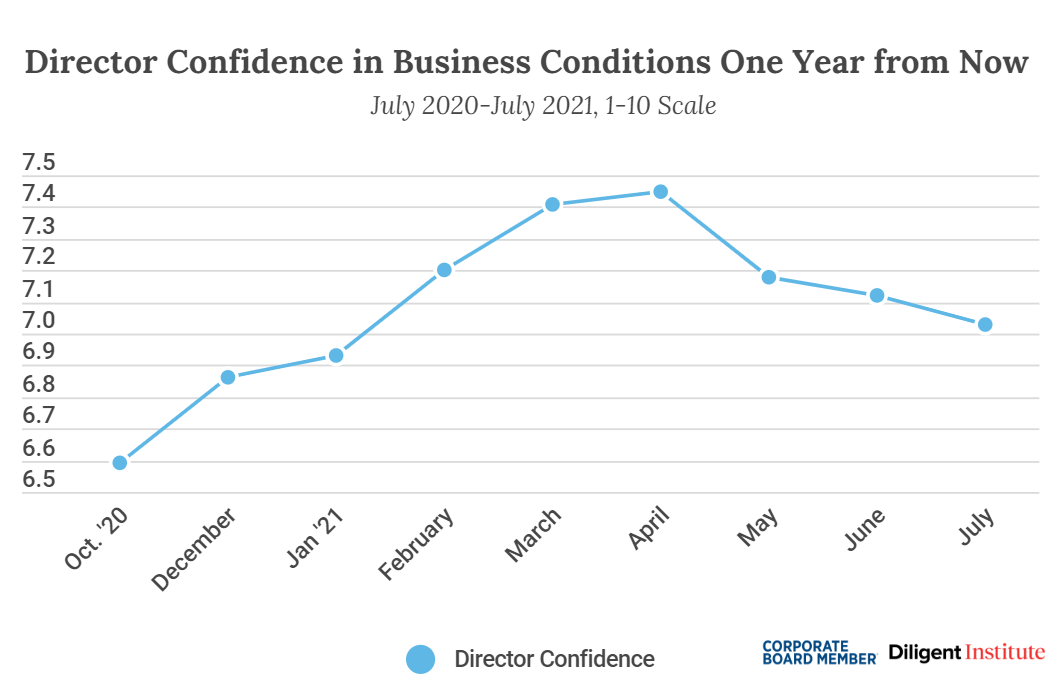

Those are the key findings from our July Director Confidence Index, a flash poll of 109 public company board members conducted in partnership between Corporate Board Member and Diligent Institute. Our leading indicator is down 1.3 percent since June, to 7.0 out of 10 on our 10-point scale. It has lost nearly 6 percent since its April high, when optimism peaked on the belief that the country was on the road to herd immunity and making a full recovery from the pandemic.

Since then, director confidence has been declining due to a series of concerns: inflation, government spending, labor shortages, slower-than-anticipated growth, tax increases, changing regulations and, of course, the new Delta variant putting a damper on business activities in the U.S. and around the world.

This is a stark difference from the CEO community, whose confidence rebounded to multi-year high (7.3/10) when polled by our sister publication Chief executive earlier this month. Directors’ outlook seems more aligned with that of their CFOs’ (6.9/10), who also find themselves on a declining trend due to inflationary pressures, according to StrategicCFO360’s latest CFO Confidence Index polling.

Nevertheless, directors’ rating of business conditions 12 months from now remains within “very good” territory, at 7/10, and many say as long as further outbreaks of Covid-19 are mitigated, companies will find ways to navigate the economic and political landscape—as they always have.

Gary LeDonne, director at MVB Financial, says he sees things getting better, but echoes many of his peers’ concerns when he adds that “improvement is contingent upon no significant Covid outbreaks.” He says returning to full employment will also be a factor in the recovery.

Adam Crescenzi, independent vice chairman of the board of trustees of Clough Global Opportunities Fund, rates his outlook an 8 out of 10 on the back of low interest rates allowing for corporate investments and pandemic-induced pent-up demand driving the economy over the coming year.

Robert J Maricich, chairman and CEO of Blackstone company International Market Centers, says he also believes strong consumer demand will continue to support his positive rating (8/10) of the business environment. He says the only scenario holding back his outlook from being “Excellent” is supply chain disruptions.

Overall, however, fewer directors participating in our July poll forecast improvements to business conditions over the coming months. Twenty-eight percent say they now expect conditions to improve by this time next year, compared to 36 percent last month—that’s a 24 percent drop.

While a similar proportion expect conditions will deteriorate (42 percent in July vs. 40 percent in June), 30 percent report not anticipating any change over that period—up 6 percentage points from 24 percent the month prior.

The Year Ahead

The proportion of directors forecasting increases in profits, revenues and capital expenditures remained fairly steady in July, ticking up only 1 to 2 percentage points from June levels. Currently, 87 percent are forecasting increases in EBITDA over the coming year (from 86 percent in June), 92 percent expect revenues to grow (from 90 percent in June), and 59 percent anticipate increasing capex over that period (from 57 percent last month).

A Sector View

Looking at director sentiment by sector, there are significant variations in confidence across sectors this month. Three are up by double digits from June—Energy, Materials and REITs—and two are down by similar margins—Industrials are down 10 percent and Health Care is down 9 percent. Financials weren’t far behind, with a loss of confidence of 7 percent.

Demand is driving confidence across all net positive sectors this month, with directors citing green initiatives, increased consumption and low interest rates as the primary reasons for that surge in optimism.

Uncertainty over the course of the pandemic, future regulations and the rate of inflation are the reasons why directors at health care and industrials companies are taking a more cautious stance.

Cybersecurity

With cyber incidents on the rise—between 800 and 1,500 businesses around the world have been affected by a ransomware attack centered on U.S. information technology firm Kaseya, according to a recent report by Reuters—directors say they’re spending more time discussing their company’s cyber plans than they were just a year ago.

Overall, 69 percent of public company directors participating in our poll say the time they devote to cyber talks in the boardroom has increased compared to pre-pandemic. This may be helping their understanding of cyber-related risks and response plan: when asked to rate their level of understanding of their company’s risks and plans to respond to a ransomware attack, directors rated them a 7.4 out of 10 and a 7.3/10, respectively.

“Cyber is a game of constantly changing offensive and defensive tactics,” says Eugene Connell, director at Erie Indemnity Company, the management company for the Erie Insurance Exchange. “The threat level appears to be growing despite continual improvement in business’s awareness and preparation.”

Dirk Junge, an independent director at railroad equipment company L.B. Foster, says the issue is “only getting more focus as AI influences business.” He says the time his board spends on the issue has increased by more than 50 percent since before the pandemic.

“Cyber crime is, perhaps, the most important organizational risk for governance leaders to be better prepared for. It is an existential risk for certain business models,” says Brad Oates, director at CIT Group.

And according to our poll, directors are hungry for specialized information on the matter. When asked about the resources they use to stay up to date on cybersecurity and cyber risk news and developments, they list their CISO (68 percent) and third-party experts (52 percent) ahead of their CEO (47 percent) and director peers (36 percent).

About the Director Confidence Index

The Director Confidence Index is a monthly survey of public company board members on the state of the overall economy, the outlook for corporate finances and other topical issues impacting public companies. Conducted in collaboration between Corporate Board Member and Diligent Institute, the Index benchmarks confidence among the governance community and is a forward-looking indicator of market movements and corporate strategies.