Fuente: Harvard Law SchooForum on Corporate Governance and Financial Regulation

Autor: Amit Batish, Equilar Inc

Since the passage of Dodd-Frank in 2010, there have been a number of regulations around executive compensation and performance that have left a tremendous influence on executive pay plans. The ever-evolving world of executive compensation oftentimes puts companies in a precarious predicament as decisions on pay could have an ample impact across an entire organization. There are several factors that change year-over-year, and there is no question that this leaves compensation committees in limbo on what is considered sound practice. These factors include pressure from investors to align executive pay with performance, sudden executive departures and much more.

This post examines a number of trending topics and issues across the corporate governance world that are affecting the executive compensation landscape. While the changes in the industry are indeed a conundrum to solve at times, the fact remains that corporations must adapt to these changes, regardless of the nuances in the process. Designing effective executive pay plans is not a simple task, yet once achieved, could pay significant dividends for the well-being of a corporation.

Aligning Pay with Performance Takes a Brighter Spotlight

One aspect of executive compensation that is sure not to change anytime soon is the pressure to align pay with performance. Contrary to certain beliefs, this does not necessarily equate to a “one-size-fits-all” model, as numerous factors come into play. In recent years, it has become imperative that corporations tell their pay story clearly and adequately, particularly as investors continue to pay closer attention to performance. Specifically, shareholders are beginning to examine pay for performance through a wider lens, as investors seek perspective on performance over a longer time horizon. Historically, three-year performance periods have reigned supreme for executive long-term incentive plans. In fact, the recent Equilar Executive Long-Term Incentive Plans report revealed that in 2017, 86.9% of Equilar 500 companies—a subset of the largest U.S. companies—utilized a three-year period for their CEO LTIPs. This represented a 17.4% increase from 2013.

While an overwhelming majority of companies utilized a three-year performance period, there is indication that the trend may be shifting toward a longer performance period in the near future. For one, CalPERS—the largest pension fund in the United States—announced earlier in 2019 that it would begin assessing the executive pay plans of the companies it invests in under a new custom five-year quantitative analysis that compares total CEO realizable pay and total stock performance relative to a company’s peers. The new framework, which utilizes a five-year time horizon, provides insight on how investors are evaluating pay for performance with a longer-term view and the potential impact on Say on Pay voting results.

In 2018, CalPERS voted against 45.4% of the S&P 500 on Say on Pay, according to corporate governance nonprofit As You Sow. These results are drastically higher than in previous years, as its five-year average for opposing Say on Pay votes was 16%.

According to Simiso Nzima, Investment Director of Global Equity at CalPERS, among the various compensation goals for CalPERS is to “ensure that the design and practice of compensation at portfolio companies appropriately incentivizes management and employees to generate long-term sustainable returns in alignment with the interests of long-term investors.”

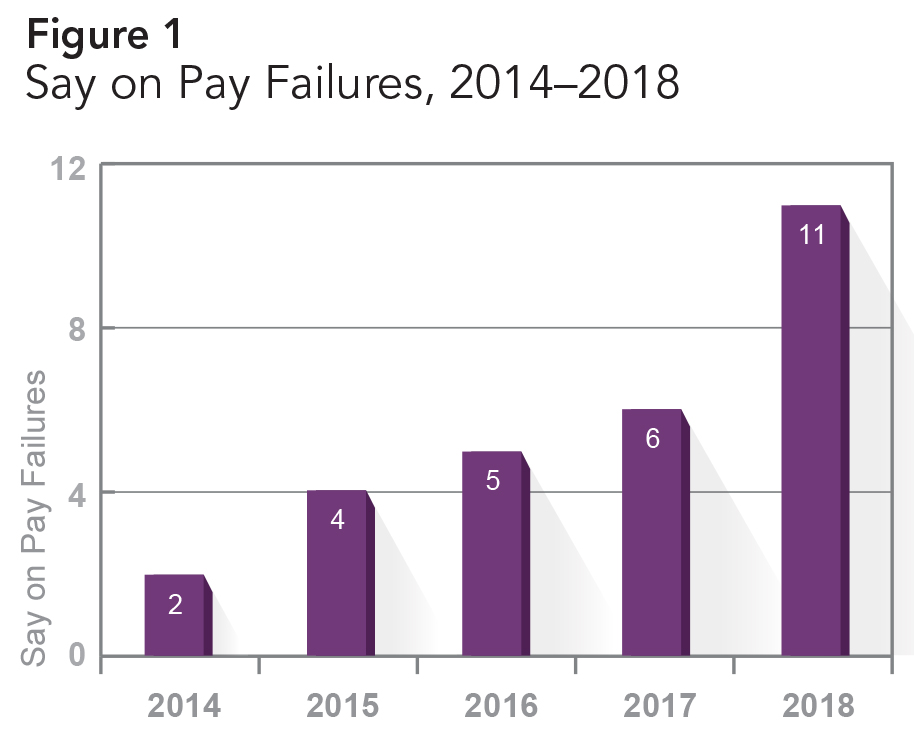

This assessment by CalPERS speaks volumes to the fact that Say on Pay continues to have a lasting impact on the executive compensation landscape almost a decade following its inaugural year. While executive compensation packages have been largely accepted by investors, 2018 saw a decrease in the approval percentage that Equilar 500 companies received. In 2018, less than half of companies received more than 95% approval on their executive pay packages, which is 10 percentage points less than the year prior. Furthermore, the number of Say on Pay failures nearly doubled from six to 11 in 2018 (Figure 1).

Interestingly, a recent Equilar study revealed that median CEO compensation in the Equilar 500 after the initiation of Say on Pay was $9.5 million, while the median pay before Say on Pay was signed into law was $6.6 million. Of course, Say on Pay is an advisory vote and does not have a direct influence on executive compensation, but this is nonetheless an interesting finding. Diving a bit deeper into this analysis, the study revealed that companies tend to shift the components of pay awarded to CEOs following a failed Say on Pay vote.

For instance, in 2017, options made up an average of 11.8% of the CEO pay mix of companies across the Equilar 500. However, of the companies that failed Say on Pay in 2017, options made up 23.2% of pay mix, a sharp increase from the average. Trends indicate that when a company fails Say on Pay multiple times, it shifts its pay packages in an effort to decrease options significantly—a sure sign that companies are at least somewhat reactive to a failed Say on Pay vote.

As the compensation landscape continues to evolve, trends suggest that investors will pay closer attention to the performance of executives, even more than ever before.

CEO Transitions and Potential Implications of Pay

There is no doubt that the prevalence of CEO departures has increased over the last year or two, and this has captured the headlines across corporate America in the process. There have been a host of factors contributing to this steady climb in departures, including retirement, poor performance, a change in company direction and scandals. While these CEO departures have placed a number of organizations in a difficult position when it comes to a successor, an often overlooked area of concern is addressing the pay packages of these departed CEOs and the pay of a future successor, whether interim or permanent.

Equilar data indicates that in 2018, there were 80 announced CEO departures across the Equilar 500—the first quarter of 2019 alone saw 26. The average lifetime pay for all 26 departing CEOs in Q1 2018 was $129.4 million—a hefty investment for companies to commit to for a top officer who may or may not be the most appropriate fit for the job.

Companies will often appoint an interim CEO while the board searches for a permanent successor following a departure. However, constructing pay packages for these individuals requires meticulous planning. According to experts at the Equilar and Nasdaq Compensation Committee Forum in 2018, corporations should consider setting up interim CEO plans as a three-to-six month agreement and award monthly salary or equity grants. If this arrangement proves to be successful, then the company can extend the plan when applicable. Experts argue that setting up these plans as a one-year engagement risks the interim CEO leaving with a full year package.

During these times of uncertainty, concern from investors also arises. While several CEO departures may be planned and with a successor in place, oftentimes sudden departures put great pressure on corporations to address investors on why they should continue investing during this tumultuous period, particularly if the departed CEO’s pay package was above average. Therefore, it is essential that companies send a strong and articulate message to investors indicating a commitment to financial well-being, and a specific plan to keep operations running smoothly.

Within any executive position, there is going to be some degree of risk associated in the hiring process. However, the aforementioned concerns around performance in combination with the rise in CEO departures—whether planned or sudden—begs the question, how do corporations prepare for such circumstances and take them into consideration when setting pay packages? There is no correct answer to this question. However, compensation committees should be cognizant of this potential reality. When a corporation invests significant dollars into a particular executive, there is a strong possibility that it can either pay great dividends or possibly result in a failed experiment—a pitfall corporations most certainly want to avoid.

Addressing Scrutiny from the “New Investor”

The overarching theme of this new era of executive compensation really centers around one area of focus—the investor. The aforementioned new CalPERS approach serves as a prime example that there is no question that we currently live in the era of the investor, particularly a new age investor. Traditional tactics for engaging with shareholders on compensation matters may not have the same effect now as they did five years ago.

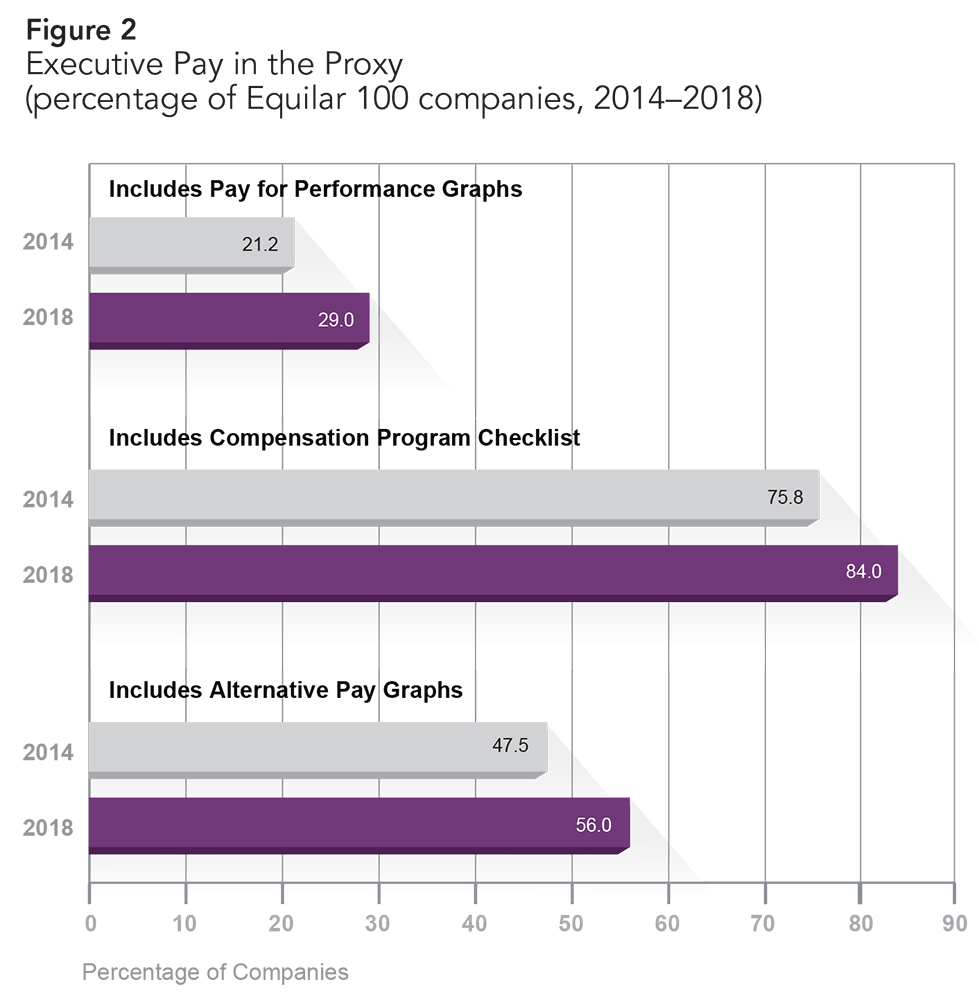

However, a number of tactics may be employed to ensure sound engagement practice with investors. A panel at the Compensation Committee Forum discussed this very issue. The panel explained that learning from peers is a critical element in the engagement process, particularly when it comes to disclosing compensation. The most effective approaches involve detailed disclosures, with some visual elements to depict trends. In fact, the Equilar Innovations in Proxy Design revealed that corporations are taking this into account at a higher rate, as the percentage of companies disclosing visual elements has increased steadily over the last five years (Figure 2).

Of course, the notion that companies should continually be engaging with their investors, regardless of whether there is an issue to address or not, still holds true. Investors want to see companies take a proactive approach as opposed to a reactive one. This sets the tone early and allows companies to be more defensible if and when they do come under scrutiny for pay packages.

Nevertheless, the landscape of executive compensation poses an interesting dynamic for compensation committees. While there will never be a correct approach to this particular compensation conundrum, the fact remains that if companies emphasize the importance of long-term growth when considering executive pay packages, then facing this new era will prove to be an achievable mountain to climb.