Fuente: Harvard Law School Forum on Corporate Governance

Autor: Shawn Cooper (Russell Reynolds Associates) and Sarah Keohane Williamson (FCLTGlobal)

Haz click aquí para acceder al estudio en formato PDF

Taking a long-term approach in business leads to superior performance.

Companies that orient themselves around a long-term time horizon while also delivering against short-term objectives have been shown to outperform their peers on several key business measures, including revenue, earnings, economic profit, market capitalization and job creation. These companies were hit hard during the last major economic downturn—as were most businesses—but saw a higher-than-average rebound after markets recovered.

According to one economic analysis, had short-term-oriented companies behaved more like long-term-oriented ones, the global economy would have created an additional $1.5 trillion in returns on invested capital in the years following the Great Recession. [1]

What Is “Long-Termism”?

It is how boards and executives think and act in regard to the practice of applying a long-term approach to business and investment decision-making, including focusing on key elements of performance such as competitive advantage, long-term objectives and a strategic plan matched with clear capital allocation priorities. It stands in contrast to short-termism, or a continued focus on quarterly or other near-term performance issues, and is increasingly in demand from stakeholders who want a fundamental rethink around how companies operate and create value.

While the benefit of long-termism is clear, the path to getting there is not. By all accounts, and for a variety of reasons, taking a long-term orientation in business can be difficult, especially for executives. But if the board of directors is committed to taking the long-view, there are a number of specific steps to they can take to get there, beginning with asking a key set of questions:.

- As a board, are we satisfied with our company’s performance?

- Is the company being fully valued in the market?

- Is the board playing an appropriate role in creating shareholder value?

Market valuation is a combination of two things: short-term performance and long-term potential. When executives over focus on one of the two—and directors don’t correct course—a company risks becoming either a flash in the pan, or a dreamer that fails to survive long enough to realize its vision. To avoid either fate, boards need to find the right balance between short-term and long-term issues, partner with executives to ensure the company is managed the same way, and engage with the market to build support for their vision and goals. It is no easy task.

Despite these challenges, there are companies that align around a long-term time horizon that successfully oriented themselves this way. In these companies, management and the board share an explicit set of behaviors that focus themselves—and often the investors too—on the long term. How did this happen? And what differentiates those boards of directors that have been the most successful at focusing their company on the long term from those that have not?

There is a clear divide between companies that align for the long term and those that do not

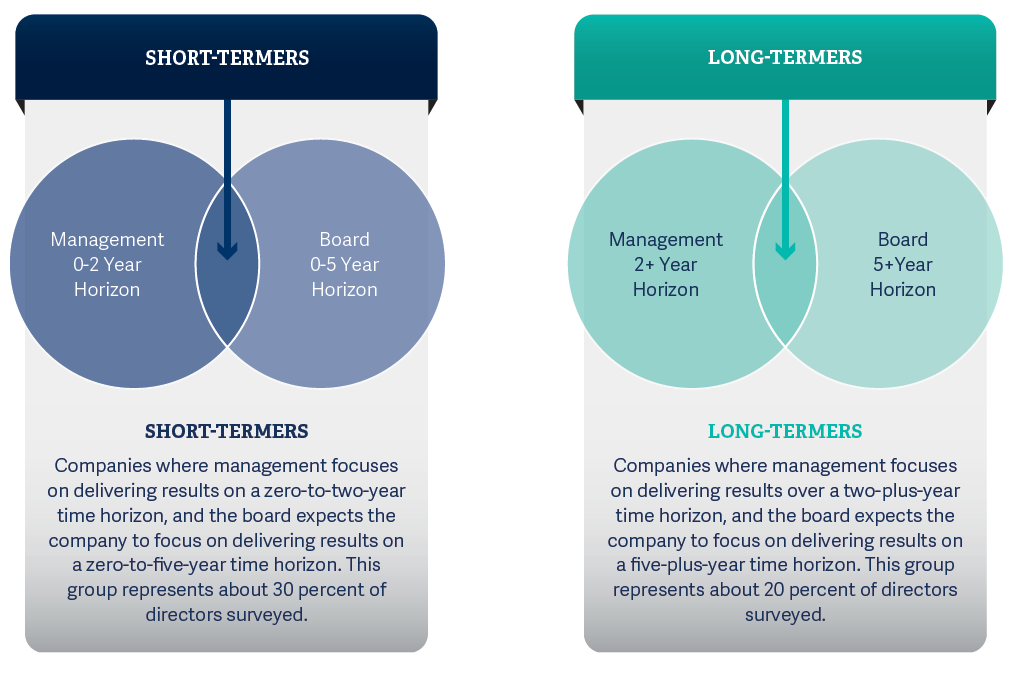

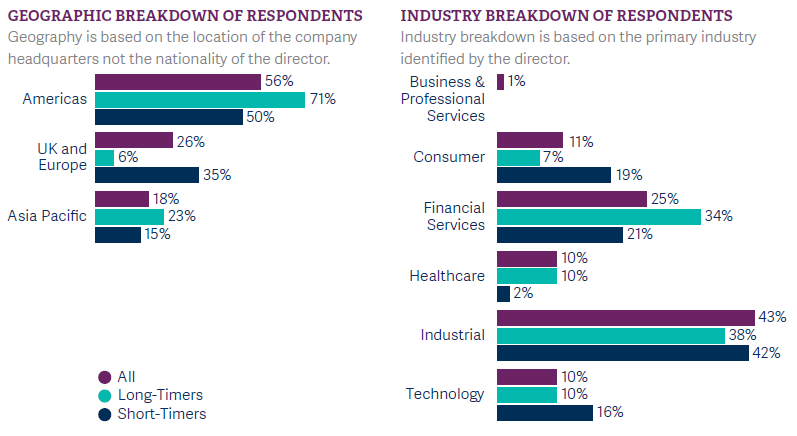

In late 2019, Russell Reynolds Associates and FCLTGlobal (Focusing Capital on the Long Term) launched an extensive research effort to understand how corporate directors consider time horizons in their work; how the topic is discussed in the boardroom, facilitating alignment between and among management and the board and investors; and how a long-term orientation influenced director recruitment, assessment and selection. This research included an in-depth global survey of 163 corporate directors. Respondents hailed from all major industry segments and all corners of the world: Fifty-six percent of respondents were at companies headquartered in the Americas, 26 percent in Europe (including the United Kingdom), and 18 percent in the Asia Pacific region.

The remaining directors served on a board where directors and management were not aligned on their time horizon focus (i.e., management was long-term oriented, while directors were short-term oriented, or vice versa).

It is worth noting, of course, that different industries are influenced by different market forces, some of which naturally result in a bias toward being more short-term or long-term oriented. The data highlighted in this report is for all respondents, and all industries, combined. See Appendix for a breakout of results by geography and industry and a brief discussion of differences between and within certain industries.

While the two groups were identified based solely on their primary time horizons, as we analyzed their responses, we saw significant differences between short-termers and long-termers on almost 30 factors measured in the study—from why they decided to be board directors in the first place through to how they conduct themselves in the boardroom.

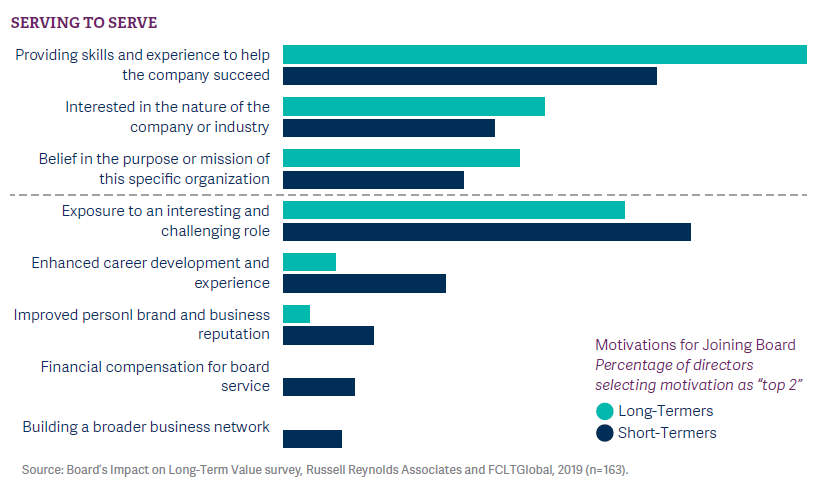

There is a stark contrast in motivation to board service between short-termers and long-termers. Long-termers are more likely to identify a primary motivation that is company-focused or altruistic in nature, such as providing skills and experience to help the company succeed, being interested in the nature of the company or industry or believing in the purpose or mission of this specific company.

Short-termers, by contrast, overwhelmingly indicated that their motivation to serve was about benefiting themselves. They were more likely to say they were motivated out of a desire for exposure to an interesting and challenging role, enhanced career development and experience, improved personal brand and business reputation, financial compensation for board service, or building a broader business network. In fact, not a single long-termer identified either of those last two reasons as a motivation for their board work.

No board intentionally goes in search of short-termer director candidates, but we found a higher prevalence of them than we would have expected to. It is a reminder that boards need to stay vigilant when identifying and assessing director candidates, and on addressing bad behaviors when they show up in the boardroom. For more guidance on this, see “From Insight to Action” below.

Today Versus Tomorrow

Once on the board, long-termers and short-termers act differently. They report focusing on different issues, discussing different topics and keeping an eye on different trends and metrics.

When it comes to identifying the most significant threats to the company’s performance, short-termers focus on issues in the here and now, like failure to execute and operate the business efficiently and failure to respond to changing customer preferences. There are times when every organization should focus on these issues, but short-termers appear to stay fixated on them beyond the point where a transition to other topics would create longer-term value.

By contrast, long-termers oriented around concerns that are more likely to play out over years or decades. They identified regulatory uncertainty, macroeconomic uncertainty and a failure to realize a return on innovation investments as their top areas of worry.

Table Stakes: What Every Board Has on the Agenda

Both groups shared a common understanding of the top three drivers that were important to the company’s strategy and success: innovating to produce new products or services, reducing cost or improving efficiency, and innovating to improve existing products or services. Given the shared focus on these issues, it seems fair to consider them table stakes for corporate boards. They are also likely topics where board leadership can focus discussion to create alignment among directors given the shared appreciation of their importance to the company. Interestingly, however, the two groups diverged significantly on what the next most important drivers were.

Short-termers were highly focused on issues related to delivering immediate results: increasing profitability, improving existing customer perceptions and satisfaction and increasing revenues. In contrast, long-termers were all about growing and expanding the business: increasing market share, expanding into new markets and growing through acquisition. Again, we see a continuation of the theme of short-termers focusing on the present and long-termers focusing on the future.

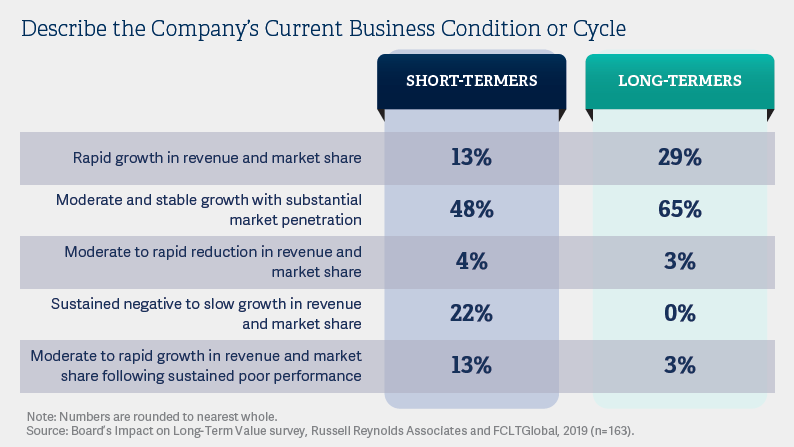

While it is certainly true that companies which are in free fall, or which are facing doubt about their ability to survive, should be more focused on the immediate than the future, it would be wrong to assume that the short-termers in this study are all facing those challenges. In fact, 61 percent of short-termers reported that their business was in a period rapid growth in revenue or market share (13 percent) or in a period of moderate and stable growth with substantial market penetration (48 percent). Another 13 percent reported moderate to rapid growth in revenue and market share following a period of sustained poor performance. These directors are not standing on burning platforms.

Not only do long-termers and short-termers report focusing on different topics during board meetings, but they also report that their board meetings operate differently from each other. Long-termers report that their board meetings are more organized and better structured relative to short-termers, that their fellow directors have a stronger grasp of organizational culture and talent issues and that their peers also have a greater level of expertise about the broader industry.

Beyond Business Acumen

One area where both groups are united? Long-termers and short-termers both say that their fellow directors rate high on business acumen (the scores between the two groups are separated by only one percentage point). It isn’t that one group is recruiting high-performing and capable directors and the other is not. But there is ample evidence that long-termers are more likely to dig in to better understand the business and industry and to come to meetings better prepared and more likely to focus on the work at hand. They are applying their skills and time differently.

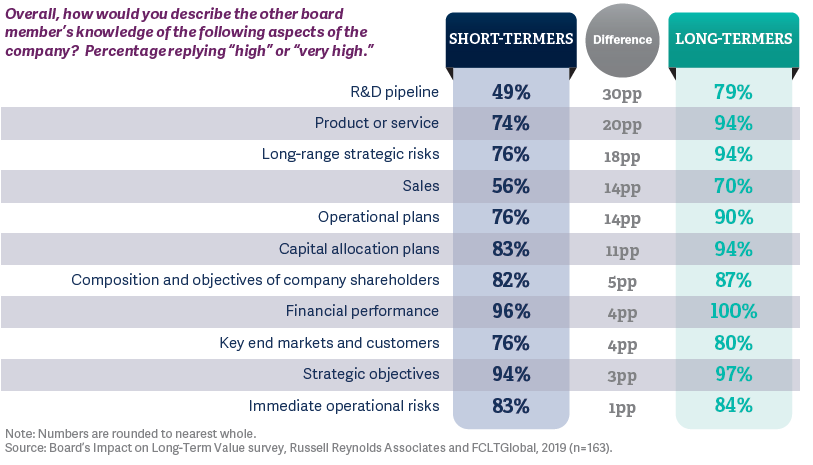

Around the boardroom table, long-termers report being significantly better informed about the company, strategy and operations—outperforming short-termers in every single area:

Remarkably, long-termers aren’t just better informed about long-term topics relative to short-termers, but they are also better informed about short-term ones. Long-termers are significantly stronger on issues related to current products and services, sales activities, operational plans, financial performance, and immediate operational risks. It is clear that long-termers understand something critical: A long-term orientation isn’t undertaken in lieu of short-term focus, but in addition to it.

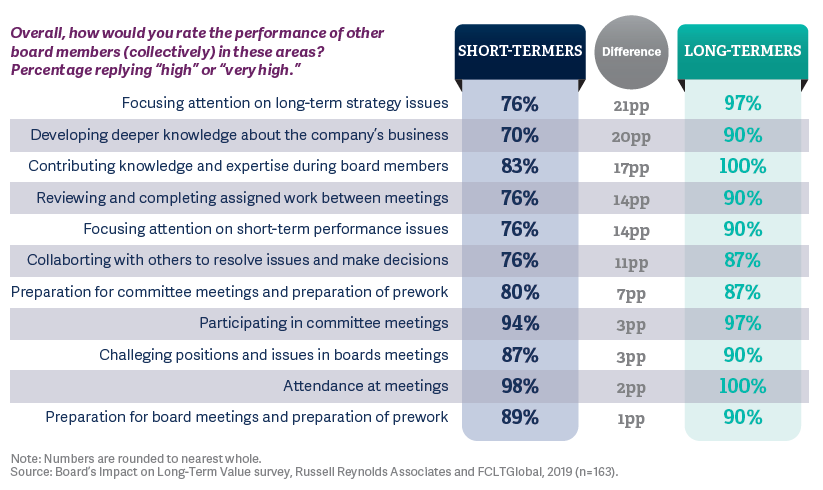

We see similar results when asking short-termers and long-termers to rate the performance of their fellow directors on behavioral issues: In every single case, long-termers dramatically outperform short-termers.

From Insight to Action

It is clear that the way the board is led, and how it uses its time, matters. Long-termers report that their board meetings are highly organized and structured, resulting in a strong board culture focused on long-term growth and performance. What can board leaders do to create an environment like that?

Previous research outlines seven specific activities directors and board leaders can take to have a positive impact on boardroom culture: [2]

- The chair needs to purposefully foster and facilitate high-quality debates around the boardroom table

- In the course of the board’s deliberations, the chair should intentionally draw out the relevant expertise of the independent directors

- All directors need to keep the discussion focused on the matter at hand and eliminate tangents during meetings

- Starting with the onboarding process and continuing throughout their tenure, directors should build and demonstrate trust through their words and actions with their fellow directors

- The board must be careful to avoid crossing the line from oversight into operations or management

- Everyone in the boardroom must be open to new ideas and ways of doing things

- Lastly, directors should remain willing to constructively challenge management when it is appropriate to do so

In addition to a willingness to challenge management, there is a need for open and honest communication between the board and management so management is clear about their board’s goals and desires for the company. Directors may desire a long-term orientation for the organization, but if they don’t guide and incentivize executives to take the same view, they’ll never get alignment between the board and management. A well-functioning corporate board of directors—one that is aligned on time horizons and communicates clearly with management—wields the power to meaningfully influence the purpose, culture and direction of the organization. There are many ways they can do so, [3] including:

- Like long-termers, focusing on both the long term and the short term in their board work. But it can be easy to create the mistaken impression of being overly focused on short-term issues by the way directors engage with executives in the boardroom. Directors need to be clear that while they are asking about both time horizons, their primary interest is on the long term. Board agendas should be crafted to include agenda items that are focused solely on long-term issues, and to frame short-term issues relative to their impact on long-term strategy. Directors may also wish to regularly review past agendas as one indicator of if they are focusing on long-term issues as much as they think they are. [4]

- Providing explicit guidance to management to be long-term While it may sound simple, it is critical for the board to explicitly communicate to executive and other employees that the board desires a long-term orientation. This doesn’t have to be complex—it can simply be a series of ongoing statements that occur during the natural course of doing business. Repetition of the message will help it become part of the culture over time.

- At the same time, making sure directors are not sending mixed messages to executives via other If a board is explicitly focused on the long term, but something like executive compensation is based on short-term performance measures, executives will naturally be conflicted. Executive compensation should be explicitly linked to long-term value creation, and the board should examine all of the key performance criteria and metrics to ensure they are not inadvertently incentivizing management to focus on the wrong thing.

- Aligning compensation to long-term value creation for the board, not just CEOs and other senior executives aren’t the only ones who should have their compensation tied to long-term value creation. Companies should compensate board members primarily in stock and consider locking up their stock awards through or beyond their terms of service.

- Developing a board statement of purpose that emphasizes long-term Amazon is perhaps the most well-known example of this, saying, “The board of directors is responsible for the control and direction of the company…. The board’s primary purpose is to build long-term shareowner value.” [5] A statement of purpose like this makes clear the role of the board and the importance of embracing a long-term orientation, and it sends a clear message to investors about how the board approaches its job.

It takes a village to create a long-term-oriented organization. While this study focused primarily on the board and management, it is also critical to establish early, frequent and open engagement with external stakeholders, including majority shareholders. They need to understand the intent, strategy and approach to creating a long-term organization. Perhaps most importantly to them, they need to understand the investment required and the anticipated payoff of taking this approach. Unless investors are persuaded, it’s likely the board will lose their support, and it may also face increased investor activism.

Lastly, building a long-term-oriented organization requires getting the right directors into the boardroom. Based on this research, it is important for nominating and governance committee chairs to understand how director candidates think and then seek to:

Establish an Evergreen Board Recruitment Process:

Many boards move from director search to director search, treating succession planning and director recruitment as transactional processes. Switching to an evergreen process, where boards start to identify pools of potential director candidates months if not years in advance of when they are needed, allows for boards to thoughtfully identify and vet candidates with the right motivations, mindset and approach.

Understand Candidate Motivations:

Directors are motivated to board service for a variety of reasons. Look for candidates who talk about service-oriented motivations (providing skills and experiences to help the company succeed, exposure to an interesting and challenging role, interest in the nature of the company or industry, belief in the purpose or mission of the specific organization) rather than motivations that focus on benefiting themselves (enhanced career development and experience, improved personal brand and business reputation, financial compensation for board service, building a broader business network). Remember to continue to probe on past experiences to get beyond cursory answers and understand how director candidates truly think.

Ask Candidates to Discuss Their Current Company’s Strengths and Threats:

Long-termers and short-termers focus on very different things when talking about their company. When talking about threats, look for candidates who focus on more macro or long-term issues (regulatory uncertainty, macroeconomic uncertainty, failure to realize a return on innovation investments) as opposed to day-to-day issues (failure to execute and operate the business effectively, failure to respond to changing customer preferences). Similarly, look for a discussion of strengths that is focused on growth and expansion (increasing market share, expanding into new markets) rather than incremental changes (increasing profitability, improving customer perceptions and satisfaction). When doing so, remember to take into consideration broader circumstances: If the company was in a turnaround, it’s both reasonable and expected for the board to be focused on shorter-term issues, but not so much when the company is in a period of prolonged growth and success.

Thoughtfully Onboard New Directors:

A solid onboarding for new directors sets them up for success. It also proves a method through which to help new directors understand the board’s perspective on business issues, including their long-term orientation. To maximize the impact of the onboarding process, ensure it is both well designed and thoughtfully executed. [6] Remember that new directors often have very different backgrounds from current directors due to a desire to bring in leaders with different skills and experiences, and these directors may well need an onboarding that emphasizes topics and issues than weren’t covered for previous directors.

For most boards of directors, there is a large gap between their current way of operating and being able to honestly say that their primary purpose is to “build long-term shareowner value.” But the benefits of doing so—to the board, management, the company and shareholders—are overwhelming, and the way to do so is clear.

A Checklist for Directors

It is clear that the way the board is led, and how it uses its time, matters. Long-termers report that their board meetings are highly organized and structured, resulting in a strong board culture focused on long-term growth and performance. What can board leaders do to create an environment like that?

- Purposefully foster and facilitate high-quality debates

- Intentionally draw out the relevant expertise

- Keep the discussion focused on the matter at hand and eliminate tangents

- Build and demonstrate trust through their words and actions

- Avoid crossing the line from oversight into operations or management

- Be open to new ideas and ways of doing things

- Constructively challenge management when it is appropriate to do so

A well-functioning corporate board of directors—one that is aligned on time horizons and communicates clearly with management—wields the power to meaningfully influence the purpose, culture and direction of the organization.

- Use clear language during discussions to emphasize that the primary focus is on the long

term - Craft boards agendas to include items that are focused on long-term issues

- Regularly review past agendas and meeting minutes to confirm time is being spent as

intended - Provide explicit guidance to management to be long-term oriented

- Ensure directors are not sending mixed messages to executives via other means

- Explicitly link executive compensation to long-term value creation

- Examine all of the key performance criteria and metrics to ensure they do not inadvertently

encourage a focus on the short term - Align compensation to long-term value creation for the board, not just management

- Compensate board members primarily in stock and consider locking up stock awards through

or beyond the term of service - Develop a board statement of purpose that emphasizes long-term interests

It is critical to establish early, frequent and open engagement with external stakeholders.

- Communicate intent, strategy and approach

- Explain the investment required and the anticipated payoff of taking a long-term approach

Lastly, building a long-term-oriented organization requires getting the right directors into the boardroom. Based on this research, it is important for nominating and governance committee chairs to understand how director candidates think and then seek to:

- Establish an evergreen board recruitment process

- Ask candidates to discuss their current company’s strengths and threats

- Understand candidate motivations

- Thoughtfully onboard new directors

Appendix

Geographic and Industry Breakdown of the Data

Consumer includes leisure and hospitality, media and entertainment, retail, and consumer products. Healthcare includes medical devices, pharmaceuticals and healthcare services. Industrial includes automotive; chemicals, materials and packaging; energy and natural resources; industrial goods; and industrial services. Technology includes hardware, software, services and telecommunications.

Four differences emerge from the industry breakdown of data:

Consumer has an elevated percentage of directors who indicated that they and the company are short-termers. This difference is driven mainly by directors from retail companies, who naturally are more impacted by short-term changes in the market and in consumer preferences.

Financial services has an elevated percentage of directors who indicated that they and the company are long-termers. This difference is driven mainly by directors from banking and insurance companies, who often must ride out short-term disruptions in the market and measure their success over longer periods of time.

Healthcare has a very small percentage of directors who indicated that they and the company are short-termers. This difference is driven mainly by directors from pharmaceuticals, who deal with multibillion-dollar investments and decades-long time horizons for drug development.

Technology has an elevated percentage of directors who indicated that they and the company are short-termers. This difference is driven mainly by directors from technology hardware businesses, who, like retailers, are naturally more impacted by short-term changes in the market and in consumer preferences.

Endnotes

1McKinsey & Company, “The Data: Where Long-Termism Pays Off,” Harvard Business Review, May–June FCLTGlobal, “Predicting Long-Term Success for Corporations and Investors Worldwide.”(go back)

2Russell Reynolds Associates, “Going for Gold: The 2019 Global Board Culture and Director Behaviors Survey.”(go back)

3FCLTGlobal, “Is My Board Cultivating the Long-Term Habits of a Highly Effective Corporate Board?”(go back)

4FCLTGlobal, “Time Visualization Meter.”(go back)

5Amazon.com, “Guidelines on Significant Corporate Governance Issues.”(go back)

6Russell Reynolds Associates, “Enhancing New Director Performance and Impact.”(go back)