Fuente: Harvard Law School Forum on Corporate Governance

Autores: Alison Omens, Aleksandra Radeva, and Kavya Vaghul, JUST Capital

Key Findings

To meet growing expectations on human capital disclosure—from investors, workers, regulators, the American public, and other key stakeholders—the country’s 100 largest employers have work to do. Between July and August 2021, JUST Capital analyzed the 100 largest U.S. employers for how they disclose across 28 metrics covering six key human capital themes—Employment and Labor Type, Job Stability, Wages, Compensation, and Benefits, Workforce Diversity, Equity, and Inclusion, Occupational Health and Safety, and Training and Education. We wanted to better understand the current state of human capital disclosure across commonly recommended standards and metrics. Overall, the data revealed three key trends:

- Disclosure is low across the board, with the disclosure rate below 20% for the majority of metrics.

- Most metrics are currently disclosed in Corporate Social Responsibility or Sustainability Reports, which do not require auditing or have standardization requirements.

- Metrics that have highest levels of disclosure are most likely to be reported in Annual Reports (10-K filings).

The Increasing Need for Human Capital Data

The connection between jobs and business performance has crystalized in the last 18 months. The COVID-19 crisis and ongoing national reckoning with racial injustice have pushed companies to support their workers in new and unprecedented ways. And now the country is experiencing a labor market that is rapidly changing, from hospitality to consulting. Workers are leaving jobs in waves, and companies are grappling with their jobs and worker strategies in an effort to keep providing services and sales at the levels needed to outperform their competitors.

This historic period has created urgency for the market, but the American public has been looking to business to step up for their workers for years. Since 2015, JUST Capital has surveyed more than 120,000 Americans on what they consider most important to just business behavior. And, year over year, the American people make it clear what they want U.S. companies to prioritize above all else: their workers.

Similarly, investors, even pre-pandemic, were starting to acknowledge the connection between human capital practices and business performance. A group of investors called the Human Capital Management Coalition petitioned the U.S. Securities and Exchange Commission (SEC) in 2017 to acknowledge the materiality of human capital practices. In 2020, the SEC took a big step forward in recognizing this reality and issued amendments to Regulation S-K, which lays out reporting requirements beyond financial statements for companies, to incorporate and describe human capital strategy as part of this reporting. After a public comment period, which included input from JUST, the final revisions took a principles-based approach to human capital disclosure. What this means is that the SEC largely left it up to companies to determine what measures were most appropriate for their business to disclose.

In August 2021, however, SEC chair Gary Gensler announced that “Investors want to better understand one of the most critical assets of a company: its people,” and that he had asked staff to propose recommendations for the Commission’s consideration on human capital disclosure. Gensler referenced that those could include “metrics such as workforce turnover, skills and development training, compensation, benefits, workforce demographics including diversity, and health and safety.” This move signals that change is coming, but it’s unclear what it might look like.

JUST Capital has been monitoring corporate disclosures on human capital metrics, and how those disclosures have changed, over the past six years. Simultaneously, various standards bodies and other organizations have put forth recommended reporting frameworks around human capital disclosure, along with holistic ESG frameworks. As an organization committed to tracking, measuring, and improving corporate stakeholder performance, we felt it was an important moment to take stock of what the state of human capital disclosure looks like today to help identify what corporate leaders might need to rise and meet possible new requirements in the future.

We therefore decided to assess the state of human capital disclosure in corporate America through the lens of the human capital frameworks that have emerged from standards-setting in recent years. We collected data from America’s 100 largest employers, and set out to ask four central questions:

- How much are companies currently disclosing on the human capital metrics that standard setters are recommending?

- Where, in a reporting framework, are companies disclosing their human capital data? For example, we see disclosure in annual filings, corporate social responsibility reports, diversity & inclusion reports, press releases, and more. This is important due to the different auditing requirements, intended audiences, and accessibility of each.

- Are those disclosures comparable for stakeholders, including investors? How much time does it take to find those disclosures?

- Have companies begun disclosing differently after the SEC’s actions in 2020?

Our Research Approach

To start to answer these questions methodically, JUST Capital designed a research project to: (1) Assess the current state of disclosures on human capital data among 100 largest U.S. employers and (2) Evaluate the degree of standardization in the way these 100 companies disclose human capital data to observe whether a common reporting standard exists. This first report focuses solely on trends in human capital data disclosure and source types among the 100 largest U.S. employers, answering the first two questions. In subsequent reports we will explore questions about standardization, timing, and policy changes.

We started to explore this research agenda by reviewing overlaps in human capital metrics proposed by various stakeholders in the field and their intersections with existing human capital reporting standards like Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), the World Economic Forum International Business Council’s report “Toward Common Metrics and Consistent Reporting of Sustainable Value Creation” (WEF IBC), and the Embankment Project for Inclusive Capital’s report (EPIC), among others. From this analysis six key themes emerged that broadly define different facets of human capital:

- Employment and Labor Type

- Job Stability

- Wages, Compensation, and Benefits

- Workforce Diversity, Equity, and Inclusion

- Occupational Health and Safety

- Training and Education

Under each of these themes, we defined a total of 35 performance-focused human capital metrics, outlined in the figure below. To collect this data, three full-time JUST Capital employees spent two months reading through corporate reports and manually recording results to find human capital metric disclosures. Due to differences in our manual data collection method for certain metrics, however, this report only analyzes data on 28 human capital metrics across five of these key themes collected between July and August 2021. (The full list of metrics, their definitions, and collection methods organized by theme can be found in the Methodology section at the end of this report.)

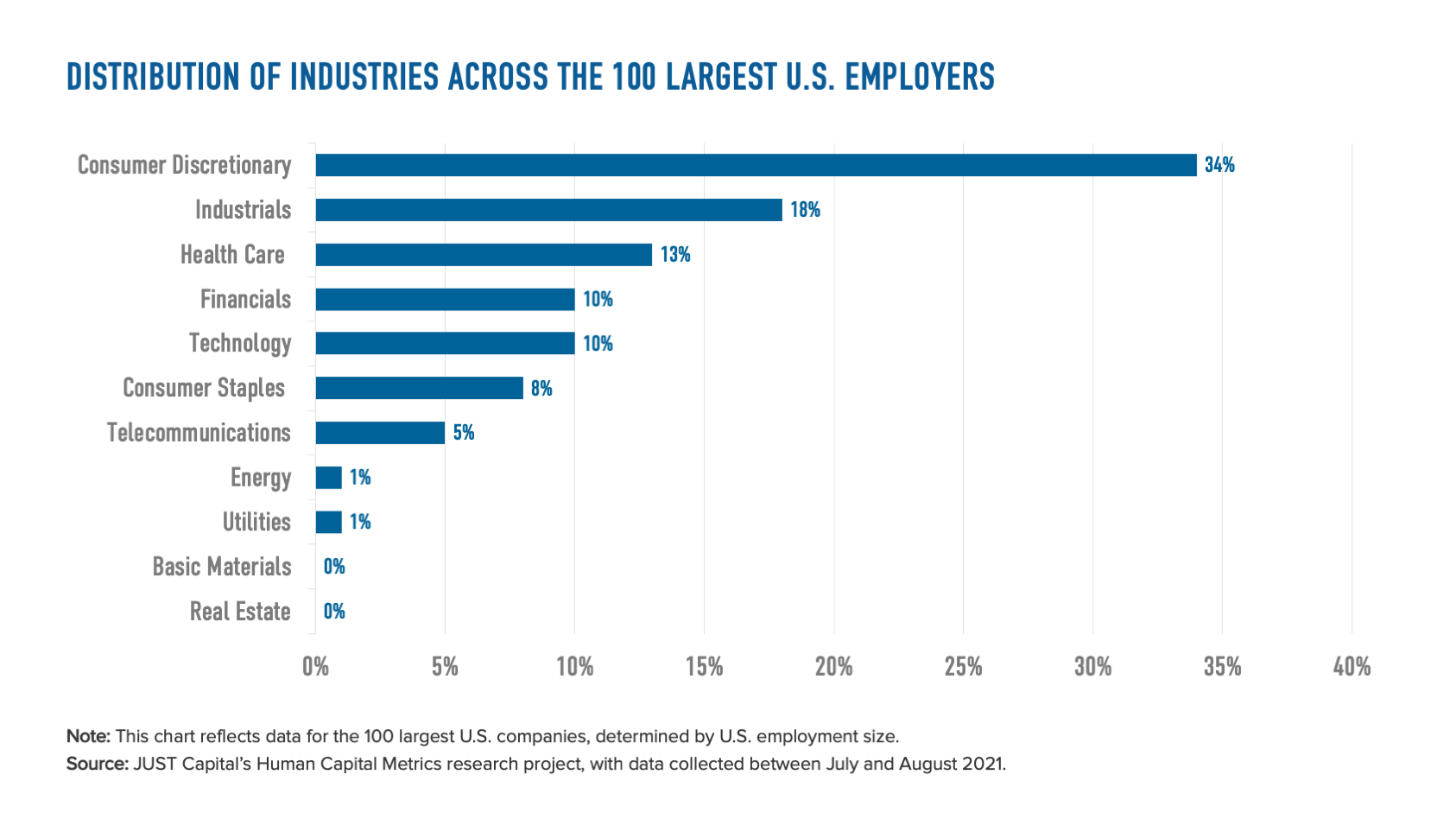

All data on these human capital metrics was collected for the 100 largest U.S. companies in the Russell 1000 Index, defined by U.S. employment size. From working on other corporate disclosure analysis like our COVID-19 Corporate Response Tracker and Corporate Racial Equity Tracker, we anticipated that this set of companies would generally have a higher disclosure rate, giving us more opportunities to explore the type of data that companies release and its format. On average, these companies employ 131,693 workers in the United States and have a market cap of $145.8 billion. The figure below illustrates the industry variation of these 100 companies. Most companies are either part of the Consumer Discretionary or Industrials sectors, which include industries like Automobiles and Parts, Retail, Household Goods and Apparel, Restaurants and Leisure, Personal Products, Media, Transportation and Industrial Goods, Building Materials and Packaging, Aerospace and Deference, Chemicals, Commercial Vehicles and Machinery, and Commercial Support Services, respectively. (For a full list of the 100 companies studied in this project, please see the Methodology section at the end of this report.)

The State of Human Capital Data Disclosure

Our data collection efforts helped reveal three key findings about the state of human capital data disclosure across five different themes and 28 metrics:

- First, human capital data disclosure is low across the board.

- Second, most human capital metrics are currently disclosed in Corporate Social Responsibility or Sustainability Reports.

- And third, metrics that have the highest levels of public disclosure are most likely to be reported in official documents—Annual Reports or 10-K Filings—that are submitted to regulatory bodies like the SEC.

Finding 1: Human capital data disclosure is low across the board

Whether looking at the theme or metric level, disclosure rates—the share of companies reporting on key human capital data is—unmistakably low. No company has at least one disclosure within each theme, and no company has disclosure on every single metric.

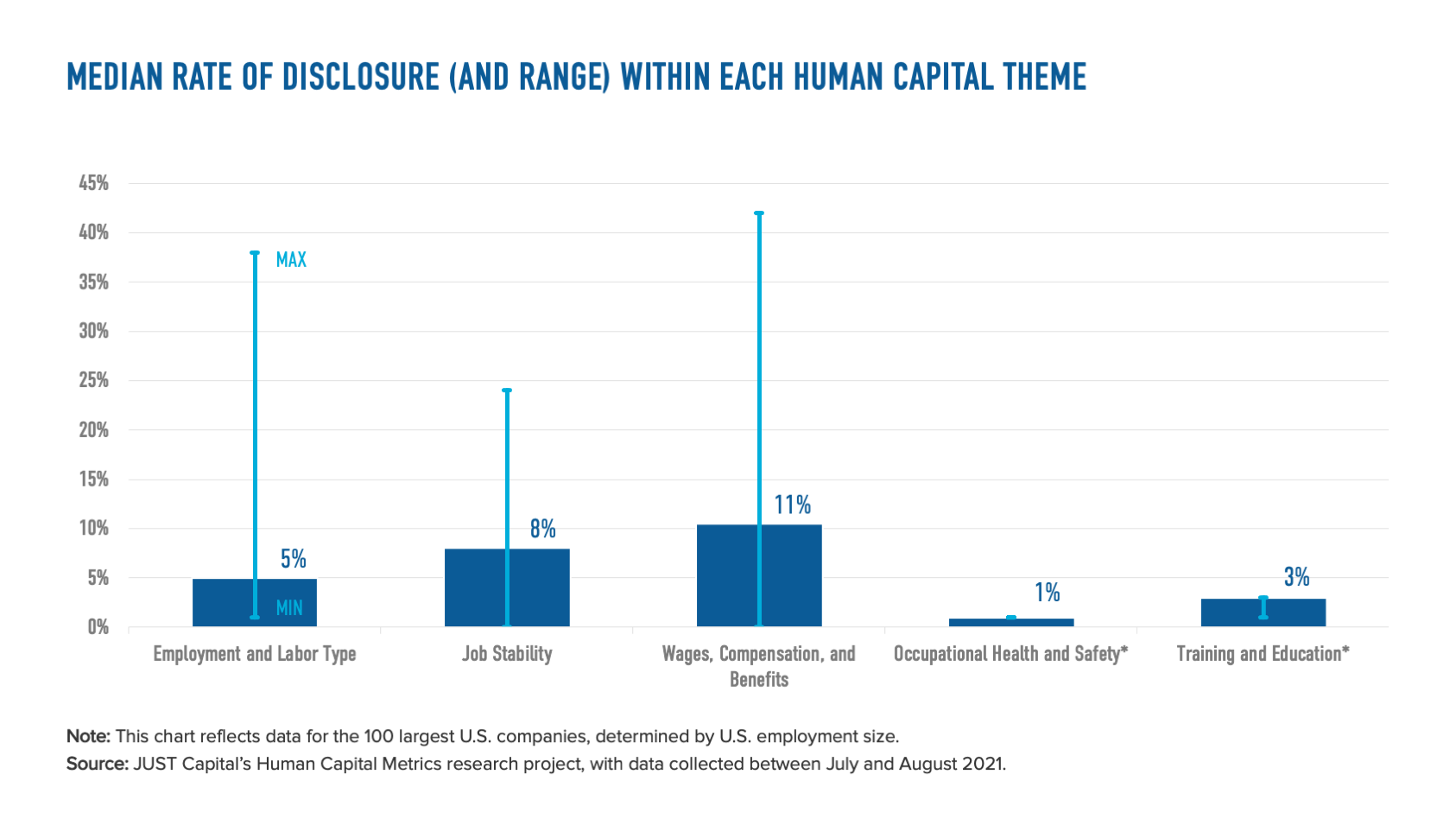

When looking at the median disclosure rate of metrics within each theme of the five themes in the following figure, we see that the typical metrics in Wages, Compensation, and Benefits theme has the highest rate (10.5%), followed by Job Stability (8.0%), and Employment and Labor Type (5.0%). The figure also highlights the range of metric disclosure rates within a given theme. This helps demonstrate that even among the themes with the highest median disclosure rates, disclosure on metrics can be highly variable. The Wages, Compensation, and Benefits theme exemplifies this trend: while having the highest median disclosure rate, some metrics within the theme have a 0% disclosure rate and one metric has a 42% disclosure rate.

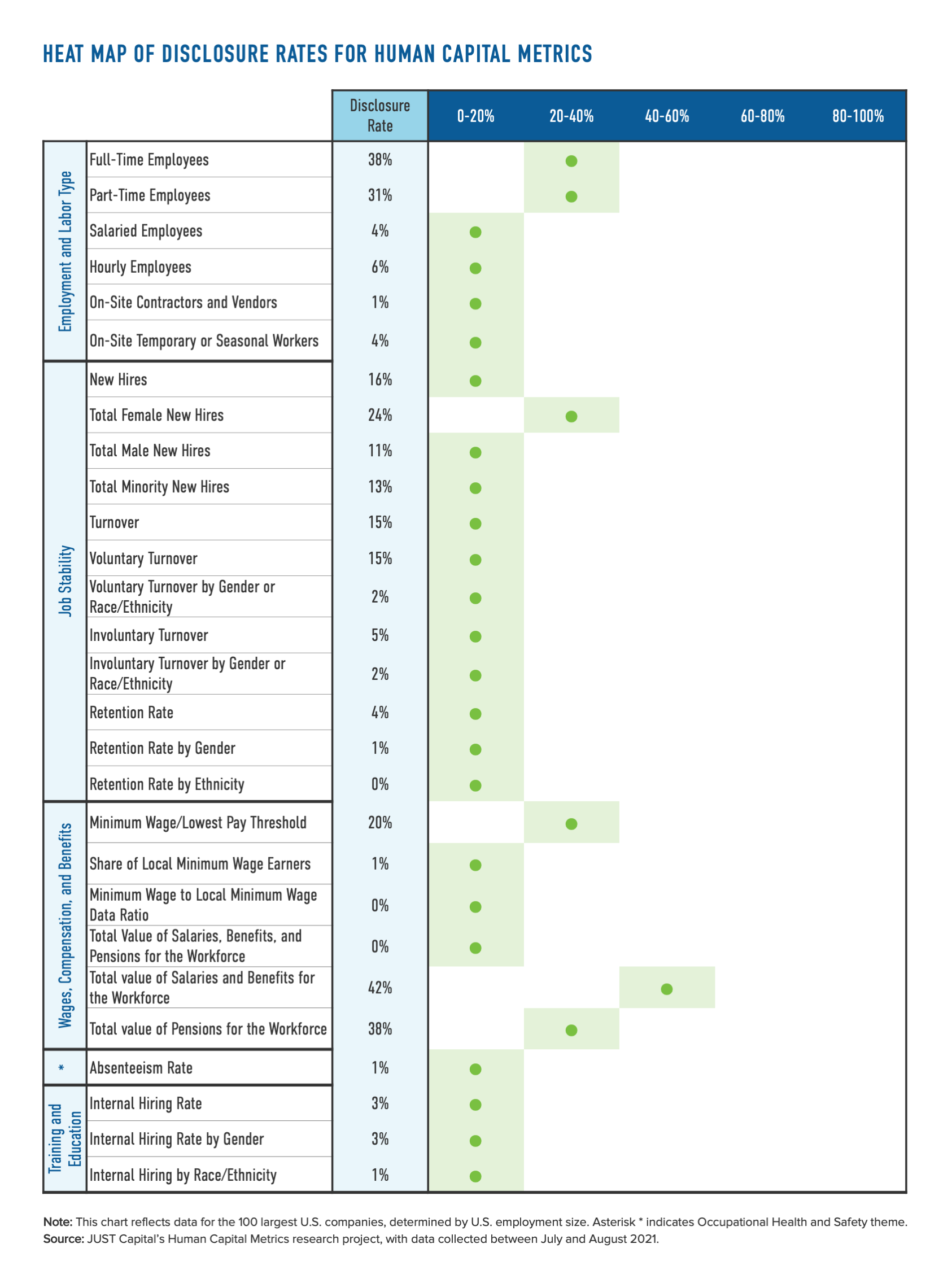

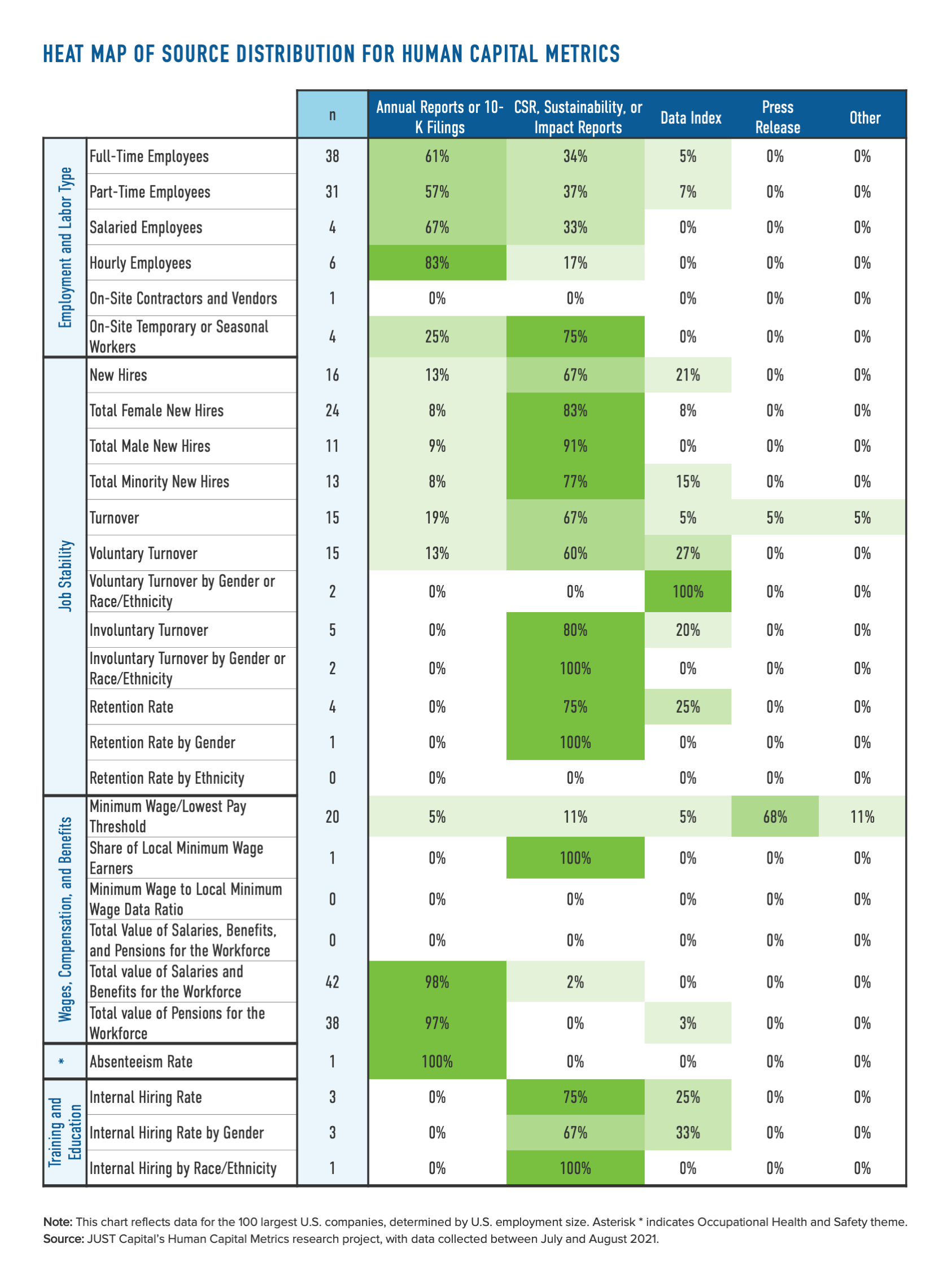

At the metric level, the trend of low disclosure becomes even starker. Not a single metric has a disclosure rate above 50%: in other words, not a single metric has a majority of companies reporting. In fact, an average of 11% and a median of 4% of companies disclose data on a given metric. The heat map below further demonstrates the low disclosure rates on metrics across the board: 23 out of the 28 metrics have a disclosure rate below 20%; five metrics have a disclosure rate between 20% and 40%; and just one metric has a disclosure rate between 40% and 60%.

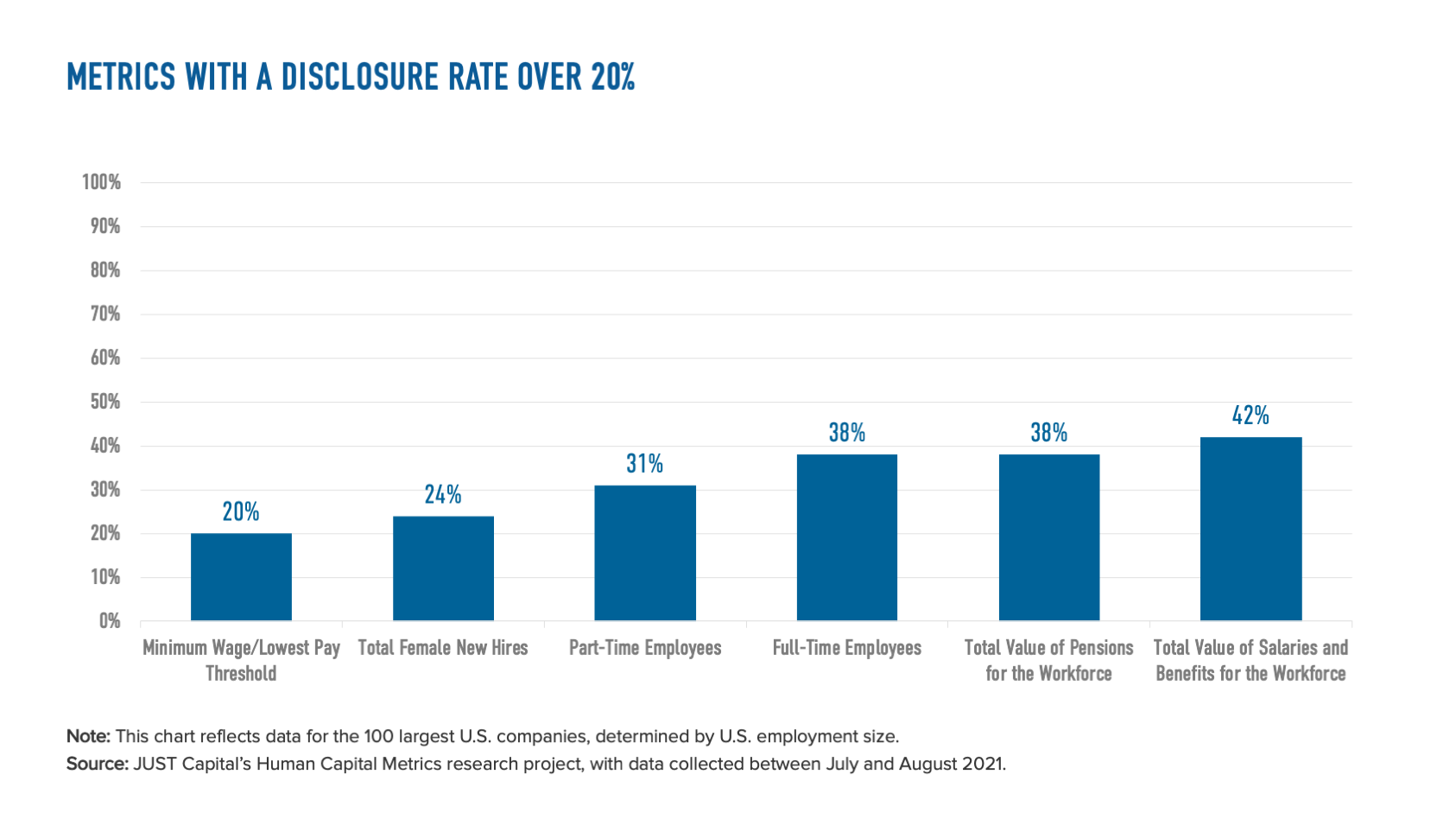

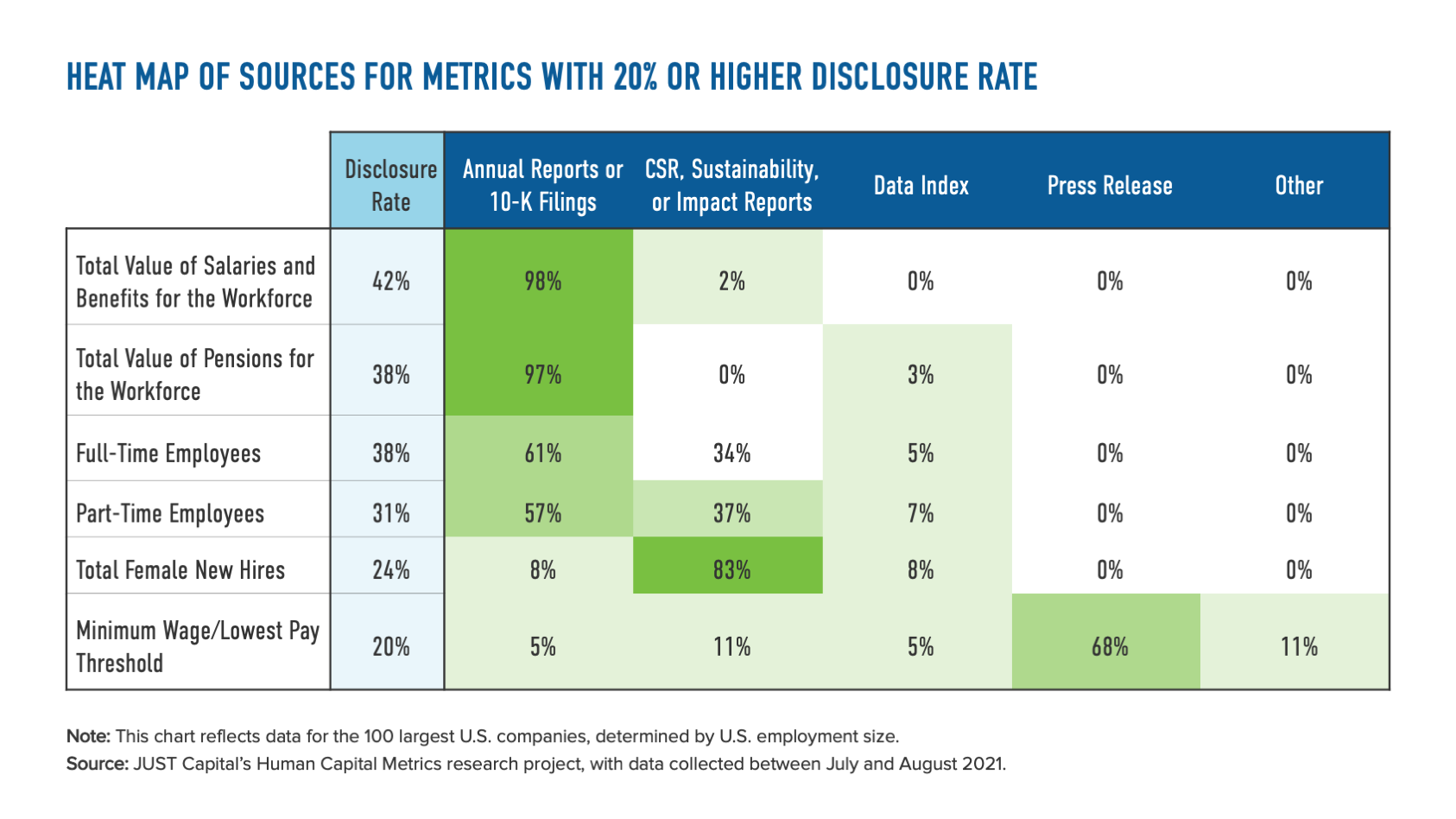

When looking at the six human capital metrics with the highest disclosure rates—Total Value of Salaries and Benefits for the Workforce (42%); Total Value of Pensions for the Workforce (38%); Full-Time Employees (38%); Part-Time Employees (31%); Total Female New Hires (24%); and Minimum Wage/Lowest Pay Threshold (20%)—we begin to see a pattern emerge. Three of these metrics focus on workforce size while the other three capture workforce costs.

While it is unclear from the SEC’s rules whether there are reporting requirements for companies above a certain size or within a specific industry to disclose these metrics, disproportionate disclosure on workforce size and cost compared to other performance-based metrics underscores the traditional view of labor as a cost or a balance sheet item as opposed to a valuable asset. As research from Harvard Business School Professor and JUST Capital Advisor Ethan Rouen finds, companies are more likely to “report detailed information about their capital investments but have almost no reporting requirements related to human capital” given how current accounting and regulatory standards systematically exclude this information.

Finding 2: Most human capital metrics are currently reported in corporate social responsibility reports

If human capital performance metrics are not required to report, where do the few companies that have some disclosures report it? Our data finds that Corporate Social Responsibility (CSR) Reports, Sustainability Reports, and other Impact Reports—external-facing, voluntary publications—are the most typical public sources for this information.

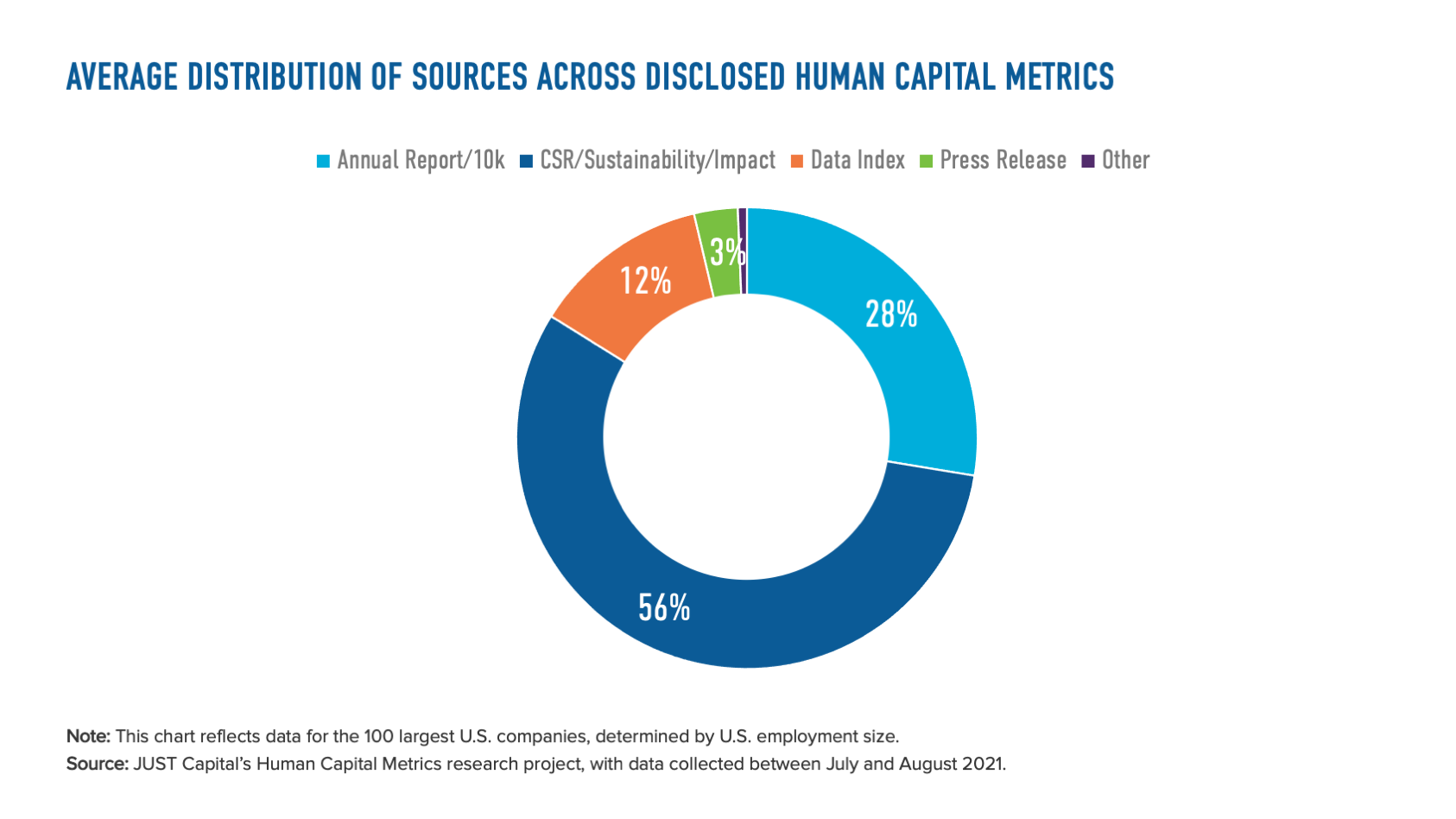

As seen in the figure below, the typical metric has the following distribution of sources for reporting: On average, most disclosures (56%) come from CSR, Sustainability, or Impact reports; 28% of disclosures are from Annual Reports (10-K Filings); 12% are from data indices, which are appendices, microsites, or even spreadsheets that contain data snapshots across a range of Environment, Social, and Governance (ESG) issues; and just 3% come from company press releases or other public announcements.

The heat map of each human capital metric by distribution of sources below helps depict the prevalence of disclosure in CSR, Sustainability, and Impact Reports. For over half of the metrics analyzed in this report, CSR, Sustainability, and Impact Reports make up the majority source type, meaning that disclosures for those metrics were most likely to be found in those sources.

The heat map also reveals an interesting outlier: Minimum Wage/Lowest Pay Threshold data, unlike every metric, is overwhelmingly found in press releases connected to announcements around hourly wage increases. Looking at the publication dates of these announcements, we noticed that the majority come from 2020 or 2021, which coincides with the renewed national conversation around increasing the federal minimum wage. Almost all companies that have disclosed minimum wage data in that time period report a lowest pay threshold of at least $15 an hour, which is in line with the proposed federal minimum wage increase.

While it is encouraging to see CSR, Sustainability, and Impact Reports leveraged for some human capital data disclosures, it is important to note that the United States—unlike some other countries – does not require companies to produce these reports, let alone on an annual basis. What’s more, because these are optional publications, there is no set standard for reporting and no auditing requirements, which provides flexibility but, simultaneously, little comparability between companies or accountability in reporting.

Finding 3: Metrics with the highest rate of disclosure are most likely to be found in Annual Reports (10-K Filings)

Bridging the first and second findings, we explored whether rate of human capital data disclosure has any relationship to source type. Sure enough, metrics with the highest disclosure rates are disproportionately likely to be found in Annual Reports (or 10-K Filings) that are submitted annually to the SEC.

Revisiting the source distribution heat map for just the six human capital metrics with the highest disclosure rate hints at this trend. The 98% and 97%, respectively, of data disclosed by companies on the Total Value of Salaries and Benefits for the Workforce and the Total Value of Pensions for the Workforce were found in Annual Reports or 10-K Filings. A lower share, albeit still a majority, of data for Full-Time Employees (61%) and Part-Time Employees (57%) were also reported in these official document filings.

What’s Next

To meet growing expectations on human capital disclosure—from regulators, investors, the American public, and other key stakeholders—the country’s largest 100 employers have work to do. Our findings show that human capital disclosure among this group remains relatively uncommon and, if available, scattered across different sources. The low overall rate of human capital disclosure we see from companies could be attributed to several factors.

Firstly, as we saw in our data collection, the mindset of workers and labor as a cost for business is still prevalent in corporate America. We see higher rates of disclosure on metrics, Total Value of Salaries and Benefits for the Workforce and Total Value of Pensions for the Workforce, and in reporting methods, Annual Reports or 10-K Filings, that reflect this. Companies have growing resources that show the materiality of disclosing other key metrics like turnover, skills development, and demographic representation. We are increasingly seeing investors asking for more information to companies increasingly embracing their human capital strategy as a key value driver.

Relatedly, there’s also a lack of understanding and consensus on what metrics companies should be using to measure human capital performance in the first place. The SEC’s principles-based approach to Regulation S-K allows companies to choose which metrics are most salient for them to report. In turn, this gap in alignment leaves interpreting the data companies are disclosing a challenge.

Without the ability to compare how companies are performing on various human capital metrics, investors can’t make well-informed decisions about where to direct their holdings, potential hires can’t factor a company’s treatment of workers into their employment choices, and customers can’t shift their purchasing practices to support companies leading the way.

There’s never been a more important, or urgent, time for companies to be transparent about how they’re leading for their workers. In the coming weeks, JUST will release additional analysis that shows the state of the standardization for these key human capital metrics, shares more about the process and the time it takes to find them, and explores how the SEC’s moves on human capital might affect the wider market.